Key points

- College Investor’s “How Much Student Loan Debt Can You Afford” calculator lets students and parents know the ultimate cost of borrowing their student loans.

- Families can switch between federal, Parent PLUS, and private loan options to understand long-term repayment costs.

- The tool highlights the impact of interest, repayment terms, and in-school payments on monthly payments after graduation.

Paying for college often means taking out student loans, but families rarely get a clear picture of how much debt is reasonable before committing. College Investor’s new interactive calculator is How Much Student Loan Debt Can You Take on Using a Calculator?aims to fill this gap.

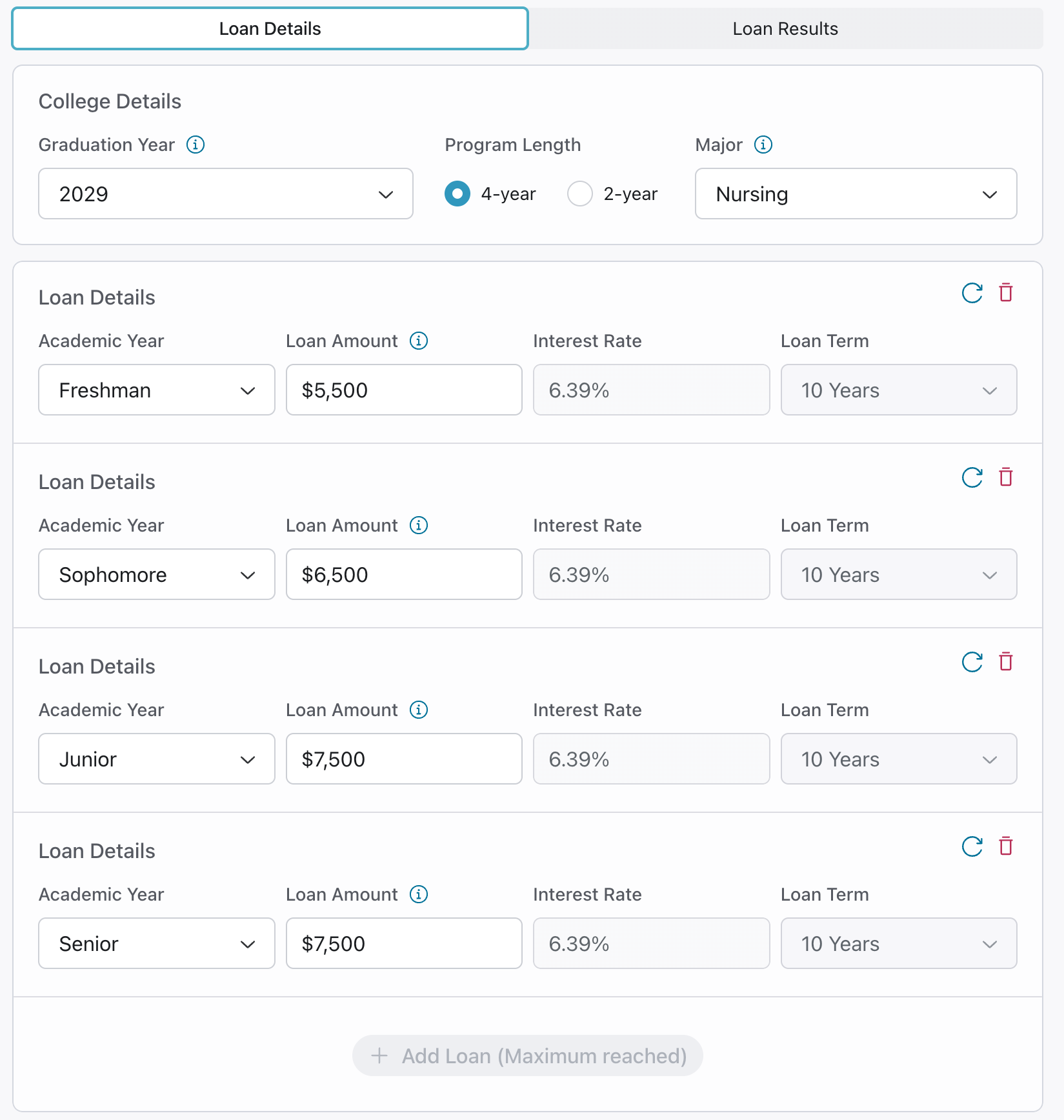

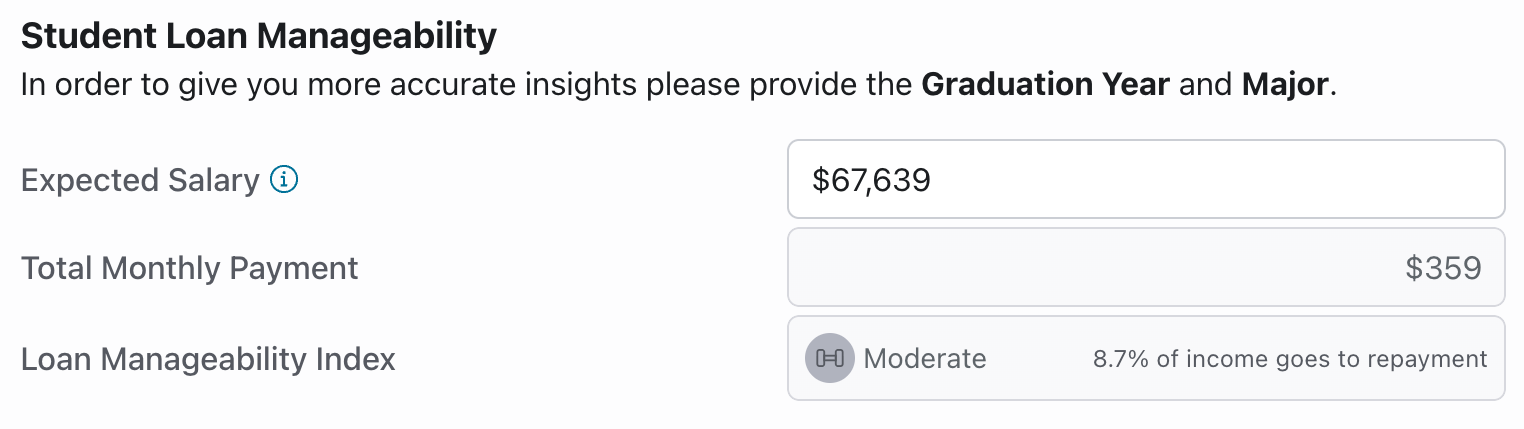

The tool goes beyond simple loan estimates by linking borrowing amounts to expected earnings after graduation, based on the student’s major. By entering their graduation year, length of program and field of study, students and parents get personalized insights about the subject Whether their debt burden will be under control compared to expected salaries.

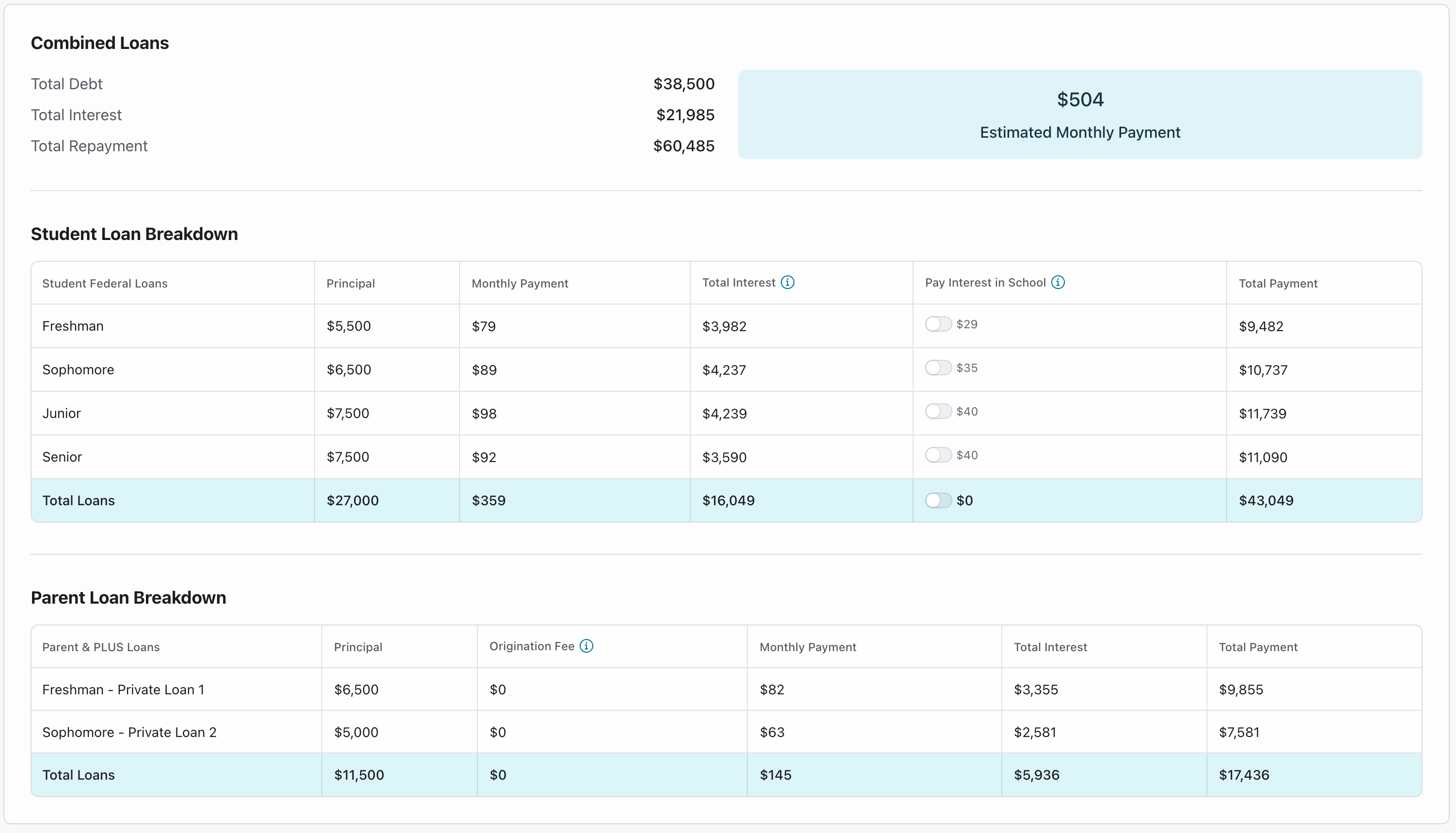

For example, a student who majors in finance and graduates in 2029 can expect an average starting salary of about $72,800, according to Federal employment data. If this student borrowed $27,000 in federal loans, the expected monthly payment would be $359. This equates to about 8% of monthly income – within the “moderate” range of repayment burdens.

How Much Student Loan Debt Can You Take on Using a Calculator?

Enter your student loan estimate and key information below to calculate what your student loan repayment will look like after graduation. It should take less than 5 minutes to complete.

How to use this calculator

This calculator has three tabs:

- Federal student loans

- Parent Plus and Private Loans

- Summary of all loans

At the bottom of both the Student section and the Parent/Private Loans section, you can see your loan Student Loan Management Index.

Federal student loans

The calculator organizes debt by school year, giving families the opportunity to see how loans accumulate over time. Federal student loan borrowing limits for students with dependents are typically $5,500 for freshmen, $6,500 for sophomores, and $7,500 for both junior and senior years.

You also need to enter your graduation year, program length, and major.

Parent Plus and Private Loans

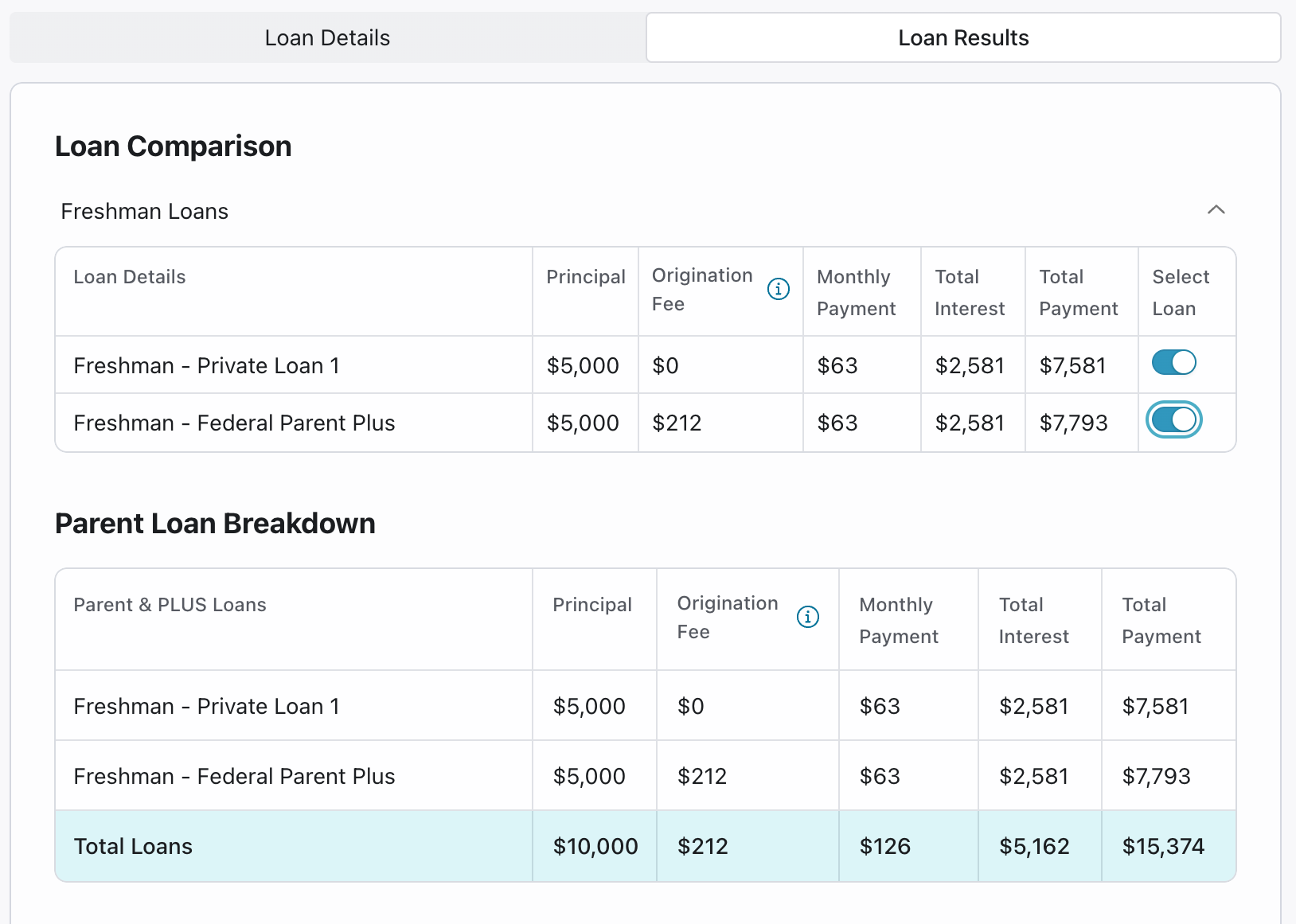

Federal student loan limits often leave many families unable to cover the full cost of attendance. This gap is often filled with Parent PLUS or private loans. The second tab of the calculator allows users to add these loans separately, specifying the loan type, amount, interest rate, and repayment term.

For Parent PLUS loans, the origination fee is calculated automatically.

You can also add more than one loan per year. This may be important as new Parent PLUS borrowing limits go into effect.

This is important to keep in mind because Parent PLUS loans carry higher interest rates and fees than federal loans for college students, while private loans vary greatly depending on creditworthiness. By entering full loan amounts, families can get a real sense of affordability.

A summary of all loans and payments due

The Summary tab consolidates all loans: Federal Student Loans, Parent PLUS, and Private Loans into one view. Families can instantly see the total amount borrowed, the monthly payment due after graduation, and the long-term cost with interest included.

Student Loan Management Index

Our favorite feature is the student loan manageability indicator that the calculator provides for students and parents. You can compare this to your monthly salary and see how much your monthly student loan repayment plan will cost.

If the number is high, you may want to reconsider your course. If the number is low, kudos!

Why this is important for families

One of the most common mistakes families make is borrowing without a realistic plan for repayment.

Nationally, 43 million Americans have federal student debt, and the average balance is about $37,000. Parent PLUS borrowers face higher averages, with balances often exceeding $50,000.

Tools like The College Investor’s “How Much Student Loan Debt Can You Afford” tool can help families make borrowing decisions based not only on need, but also on the student’s earning potential.

This context is crucial: Borrowing $40,000 may be possible for a finance or engineering major, but it can be much more burdensome for graduates in fields with lower starting salaries. It’s essential to make sure you get a return on your college investment!

Key takeaways for students and parents

- Link borrowing to professional expectations. Use specialty-based salary data to evaluate whether future payments can be managed.

- Track loans year after year. Understand how borrowing grows over time, and consider paying interest while you’re in school to limit your overall costs.

- Compare loan types. Prime loans and private loans differ in cost and repayment flexibility – design these before you decide.

- Aim for affordability. A common rule of thumb is to keep monthly student loan payments below 10 percent of projected monthly income.

By making the repayment process more transparent before loans are signed, The College Investor’s “How Much Student Loan Debt Can I Take” calculator gives families a clearer view of the trade-offs involved and a better chance of keeping college debt under control.

Don’t miss these other stories:

Best Student Loan Payment Plans (Updated for OBBBA)

2026 – 2027 Student Aid Index (SAI) chart and calculator.

Is college worth it in 2025? It depends on how much you spend

The post How Much Can You Afford Student Loan Debt Calculator appeared first on The College Investor.