Main points

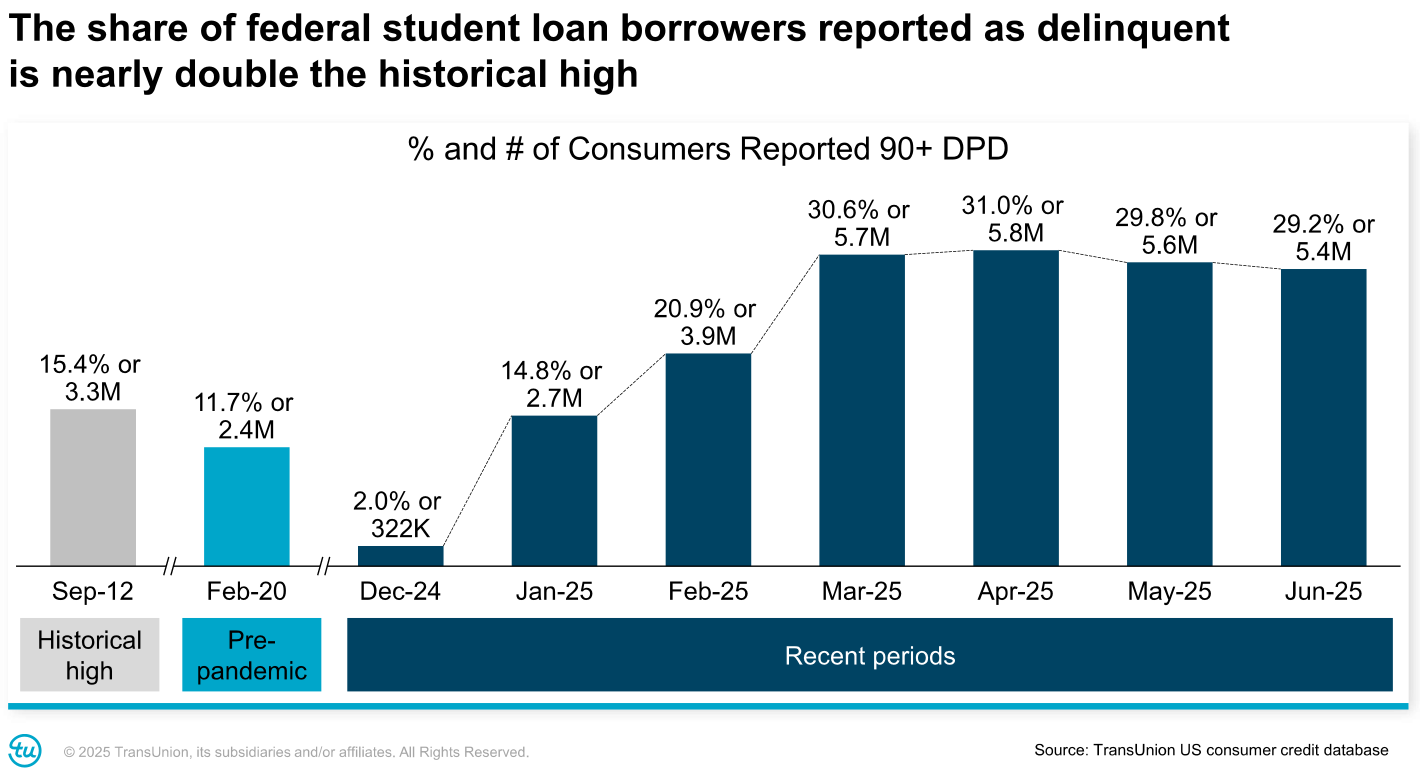

- 29 % of federal student loans (5.4 million people) are still influenced, according to transunion.

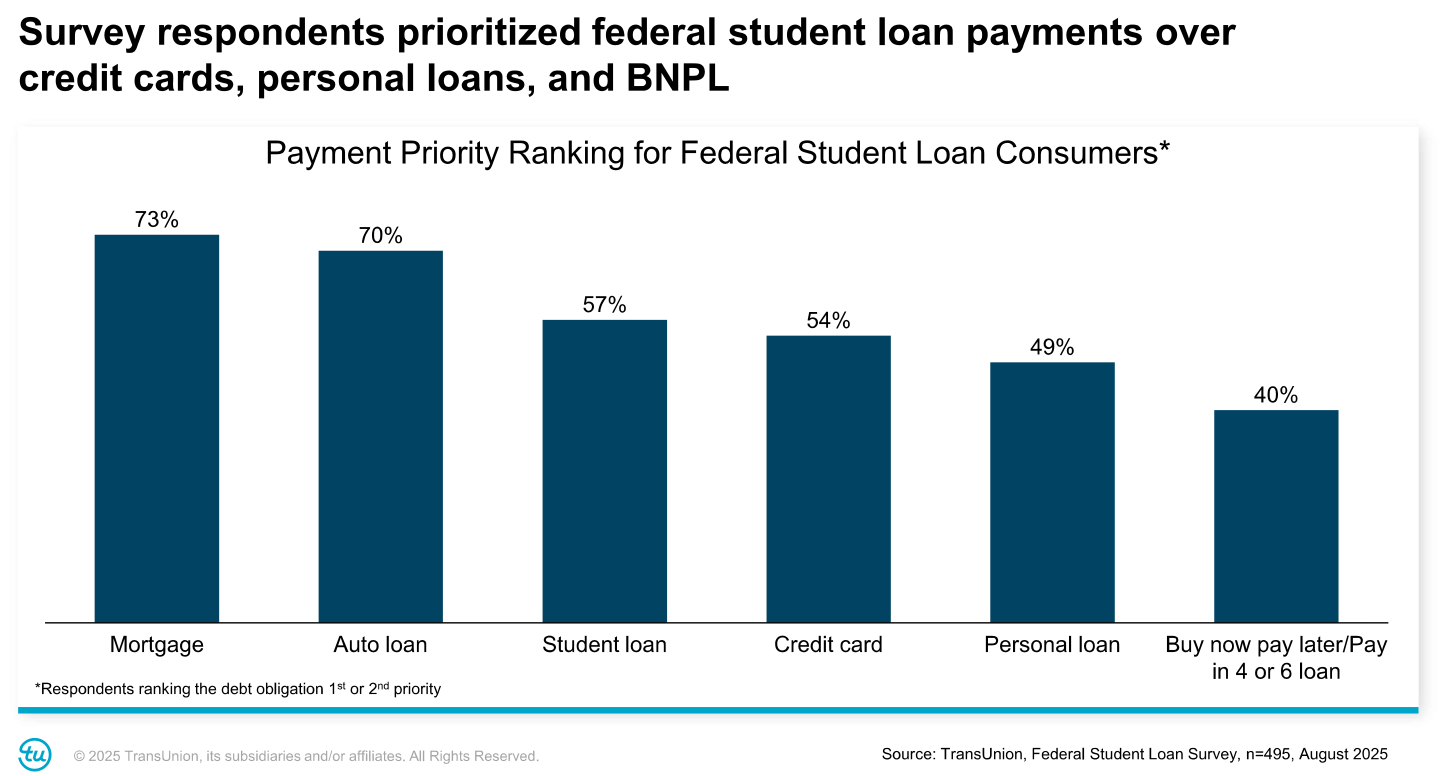

- A new survey indicate that many borrowers may give priority to student loans before credit cards and personal loans when resuming wages or recovering tax funds.

Consumer morale shows that borrowers disappear competing bills, with concerns related to the ability to pay missed payments.

Federal students loan borrowers are subject New data released this week.

In July 2025, 29 % of the federal loan borrowers were in payment, or about 5.4 million people, at least 90 days on payments. While this number is just lower than April 2025 by 31 %, it represents Fifth month in a row with more than five million borrowers due.

The modest improvement indicates that some families have managed to catch up, but the general level of delinquency is still historically high. For comparison, the rates of delinquency before the epidemic were about 10 % to 15 %, depending on the income and the type of loan, according to the statistics of the student loan invested in the college.

“While the percentage of homogeneous federal loans to the homogeneous student loans has seriously calmed down in recent months, it is certainly high.In a statement, Michel Raniri, Vice President and Head of American Research and Consulting in Trossion, said in a statement.

The percentage of borrowers is very dangerous, and as soon as they reach 270 days, they will be in a state of failure and confrontation, tax displacement, and more. This comes just before the tax season, when millions of Americans depend on tax recovered amounts.

Do you want to save this?

The ability to bear the costs and confusion lost payments

Behind these numbers, it lies a simple fact: Many borrowers say they simply cannot bear their monthly payments. Nearly half (49 %) of federal student loans are currently missing payments that have mentioned the ability to afford cost as a major reason. A third said that they were prioritized for other bills, such as rent, facilities, or medical expenses, on student loan payments.

However, confusion also plays a big role. Nearly a quarter (24 %) said they are waiting for more information about tolerance or payment programs. This is in line with what we see with confusion about the savings plan and other student loan payment plans. It is also in line with the common feelings that we saw when the credit degrees of borrowers were affected for the first time earlier this year – many of them had no idea of payment.

One of the big issues is that inflation and high interest rates have pressured family budgets. During the three -year student loans ’loans, many borrowers have received additional credit to cover the living expenses. Now, the resumption of student loan payments means a new debt sorcery alongside those old.

Feelings captured in the Transunion Survey emphasize the case. Borrowians have expressed widespread concern about the potential appeal of wage wheel or other assembly activities. Many people are concerned that these measures can harm their families more, especially for low -income families that are already struggling with housing, food or childcare costs.

The groups that wave on the horizon may change the borrower’s priorities

The Ministry of Education has the authority to decorate wages, tax recovery, and even withhold the benefits of social security from backward borrowers. With the already resuming assembly activity, many borrowers have to rethink how they deal with their bills.

The latest poll from the transunion found that although most borrowers give priority to mortgage loans and their auto loans first, the possibility of student loan groups pays student loans to the top in the list.

In practice, this means that borrowers may choose to allow credit card or personal loan assets to slip before the student loan is lost.

Student loan borrowers are a small sub -group of borrowers

It should be noted that high delinquency rates are specially applied to student loan borrowers in a serious problem.

While 5.4 million borrowers represent a large part of about 43 million borrowers in the Federal Student Loan Portfolio, they represent a relatively small part of more than 200 million active credit consumers in the United States.

However, the influence on lenders, soldiers and the wider economy is far from coercion. Lenters must manage cars, mortgage and personal loans to calculate the priorities of paying these borrowers, especially with the return of involuntary groups via the Internet.

What does this mean for borrowers

For millions of families in the delinquency of student loans, the next few months may provide difficult options. If the borrowers end up in the end, they can see their decorated or recovery salaries. This may force some to make student loans a higher priority than other debts.

For families that are still currently on their payments, data provides a warning. The increasing rise in credit cards and personal loans indicates that the knees in one area can quickly leak to others. The budget can carefully help, make loans payment plan for students, or unify other debts to avoid more dangerous financial consequences.

Federal students have some options before failing to pay – including obtaining a paid payment plan and resuming payments. Income -based payment plans can determine monthly bills by a percentage of income, and low -income borrowers may have $ 0 per month. A legal loan. Battlers may also be eligible for rehabilitation programs, which can stop groups if certain conditions are met.

Fast food

- Virtual settings are still high: About 29 % of the payment borrowers (5.4 million people) are more than 90 days of delinquents, just a slight improvement earlier this year.

- Consultation groups can be converted: With the removal of wages and taxes on the horizon, many borrowers may give priority to student loans before other unpaid debts.

- The ability to withstand costs is the central issue: Nearly half of the delusional borrowers say they simply cannot afford payments, which confirms the pressure of high cost of living.

Do not miss these other stories:

The best high -return savings accounts in October 2025

Leave a memorization plan: options for borrowers

Can President Trump reflect the student loan?

Editor: Colin Griffs

New Publishing Data: 5.4 million loans student who abandoned their loans first appeared on the college investor.