Understanding how much you owe in federal income tax starts with knowing your tax brackets and how they shift year after year. Below you’ll find the latest IRS tax tables, standard deduction amounts, historical comparisons, and tips for estimating the withholding more accurately.

This includes the most recent data from tax years 2025 and 2026.

Check it out if you’re looking for specific capital gains tax brackets and rates.

What you will learn

- Federal income tax brackets for 2025 and 2026 (depending on filing status)

- Modify standard deduction amounts

- Compare historical bows

- How to estimate deduction and tax burden

- Key caveats and tax planning considerations

2025 federal tax brackets

Below are the federal tax brackets for 2025. Remember, these are not the amounts you submit on your tax return, but rather the amount of tax you will pay from January 1, 2025, to December 31, 2025. The ranges for these brackets have increased significantly for 2025 due to higher inflation.

The table below shows the tax bracket/rate for each income level:

2025 standard deduction

The standard deduction for 2025 also increased due to inflation, which you can see in the table below. the OBBBA also increased the standard deduction Or the 2025 tax year retroactively.

|

Standard deduction amount |

|

|---|---|

|

Deposit status |

2025 |

|

bachelor |

$15,750 |

|

Married filing jointly |

$31,500 |

|

Head of household |

$23,625 |

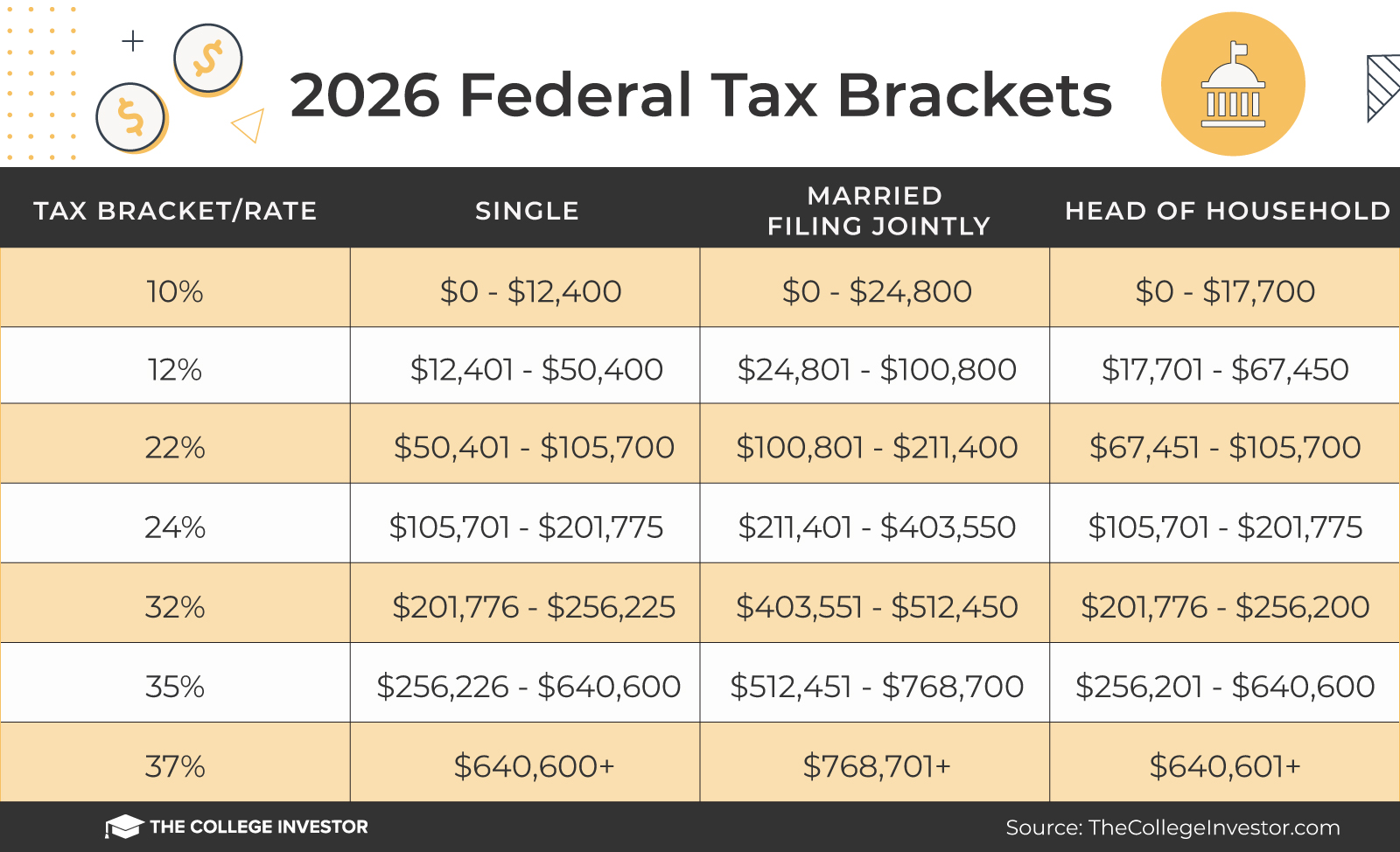

2026 federal tax brackets

Below are the federal tax brackets for 2025. Remember, these are not the amounts you submit on your tax return, but rather the amount of tax you will pay from January 1, 2026, to December 31, 2026. The ranges for these brackets have increased slightly for 2026 due to higher inflation.

The table below shows the tax bracket/rate for each income level:

2026 The standard deduction

The standard deduction also increased for 2026, due to inflation and changes from the OBBBA.

|

Standard deduction amount |

|

|---|---|

|

Deposit status |

2026 |

|

bachelor |

$16,100 |

|

Married filing jointly |

$32,200 |

|

Head of household |

$24,150 |

Tax brackets for the previous year

Looking for some history? Below are past years’ tax brackets and standard deduction levels.

For 2020 and 2021, the federal tax brackets are largely similar to what you saw in 2019. There are some minor changes, but nothing as major as we saw from 2017 to 2018 with the Trump Tax Cuts and Jobs Act. However, 2022 is the year where things start to expand a bit.

The bottom line is that all the upper limits of the tax bracket have risen slightly.

The tables below show the tax bracket/rate for each income level:

Here are the federal tax brackets for 2024.

Here are the federal tax brackets for 2023.

Here are the federal tax brackets for 2022. Remember, these are the amounts you will pay when you file your taxes from January to April 2023 (for the year January 1, 2022, to December 31, 2022).

The table below shows the tax bracket/rate for each income level:

|

Tax bracket/rate |

bachelor |

Married filing jointly |

Head of household |

|---|---|---|---|

|

10% |

$0 – $10,275 |

$0 – $20,550 |

$0 – $14,650 |

|

12% |

$10,276 – $41,775 |

$20,551 – $83,550 |

$14,651 – $55,900 |

|

22% |

$41,776 – $89,075 |

$83,551 – $178,150 |

$55,901 – $89,050 |

|

24% |

$89,076 – $170,050 |

$178,151 – $340,100 |

$89,051 – $170,050 |

|

32% |

$170,051 – $215,950 |

$340,101 – $431,900 |

$170,051 – $215,950 |

|

35% |

$215,951 – $539,900 |

$431,901 – $647,850 |

$215,951 – $539,900 |

|

37% |

$539,901+ |

$647,851+ |

$539,901+ |

Here are the federal tax brackets for 2021.

The table below shows the tax bracket/rate for each income level:

|

Tax bracket/rate |

bachelor |

Married filing jointly |

Head of household |

|---|---|---|---|

|

10% |

$0 – $9,950 |

$0 – $19,900 |

$0 – $14,200 |

|

12% |

$9,951 – $40,525 |

$19,901 – $81,050 |

$14,201 – $54,200 |

|

22% |

$40,526 – $86,375 |

$81,051 – $172,750 |

$54,201 – $86,350 |

|

24% |

$86,376 – $164,925 |

$172,751 – $329,850 |

$86,351 – $164,900 |

|

32% |

$164,926 – $209,425 |

$329,851 – $418,850 |

$164,901 – $209,400 |

|

35% |

$209,426 – $523,600 |

$418,851 – $628,300 |

$209,401 – $523,600 |

|

37% |

$523,601+ |

$628,301+ |

$523,601+ |

The standard deduction also increased slightly for 2021, which you can see in the table below.

|

Deposit status |

2021 |

|---|---|

|

bachelor |

$12,550 |

|

Married filing jointly |

$25,100 |

|

Head of household |

$18,800 |

Here are the federal tax brackets for 2020.

|

Tax bracket/rate |

bachelor |

Married filing jointly |

Head of household |

|---|---|---|---|

|

10% |

$0 – $9,875 |

$0 – $19,750 |

$0 – $14,100 |

|

12% |

$9,876 – $40,125 |

$19,751 – $80,250 |

$14,101 – $53,700 |

|

22% |

$40,126 – $85,525 |

$80,251 – $171,050 |

$53,701 – $85,500 |

|

24% |

$85,526 – $163,300 |

$171,051 – $326,600 |

$85,501 – $163,300 |

|

32% |

$163,301 – $207,350 |

$326,601 – $414,700 |

$163,301 – $207,350 |

|

35% |

$207,351 – $518,400 |

$414,701 – $622,050 |

$207,351 – $518,400 |

|

37% |

$518,401+ |

$622,051+ |

$518,401+ |

Here are the federal tax brackets for 2019.

|

Tax bracket/rate |

bachelor |

Married filing jointly |

Head of household |

|---|---|---|---|

|

10% |

$0 – $9,700 |

$0 – $19,400 |

$0 – $13,850 |

|

12% |

$9,701 – $39,475 |

$19,401 – $78,950 |

$13,851 – $52,850 |

|

22% |

$39,476 – $84,200 |

$78,951 – $168,400 |

$52,851 – $84,200 |

|

24% |

$84,201 – $160,725 |

$168,401 – $321,450 |

$84,201 – $160,700 |

|

32% |

$160,726 – $204,100 |

$321,451 – $408,200 |

$160,701 – $204,100 |

|

35% |

$204,101 – $510,300 |

$408,201 – $612,350 |

$204,101 – $510,300 |

|

37% |

$510,301+ |

$612,351+ |

$510,301+ |

Here are the federal tax brackets for 2018. This has been a year of big change due to the Tax Cuts and Jobs Act.

|

Tax bracket/rate |

bachelor |

Married filing jointly |

Head of household |

|---|---|---|---|

|

10% |

$0 – $9,525 |

$0 – $19,050 |

$0 – $13,600 |

|

12% |

$9,526 – $38,700 |

$19,051 – $77,400 |

$13,601 – $51,800 |

|

22% |

$38,701 – $82,500 |

$77,401 – $165,000 |

$51,801 – $82,500 |

|

24% |

$82,501 – $157,500 |

$165,001 – $315,000 |

$82,501 – $157,500 |

|

32% |

$157,501 – $200,000 |

$315,001 – $400,000 |

$157,501 – $200,000 |

|

35% |

$200,001 – $500,000 |

$400,001 – $600,000 |

$200,001 – $500,000 |

|

37% |

$500,000+ |

$600,001+ |

$500,000+ |

Calculate your deduction

If you want to calculate your tax withholding, you can use the IRS tax withholding calculator located at https://apps.irs.gov/app/withholdingcalculator/.

And note that in addition to federal taxes, you also have to pay FICA taxes. These are payroll taxes that go to Social Security and Medicare. Additionally, you may have to pay state taxes depending on your state.

Editor: Colin Greaves

Reviewed by: Ohan Kaekchian, Ph.D., CFP®

The post Federal Income Tax Brackets and IRS Tax Tables appeared first on The College Investor.