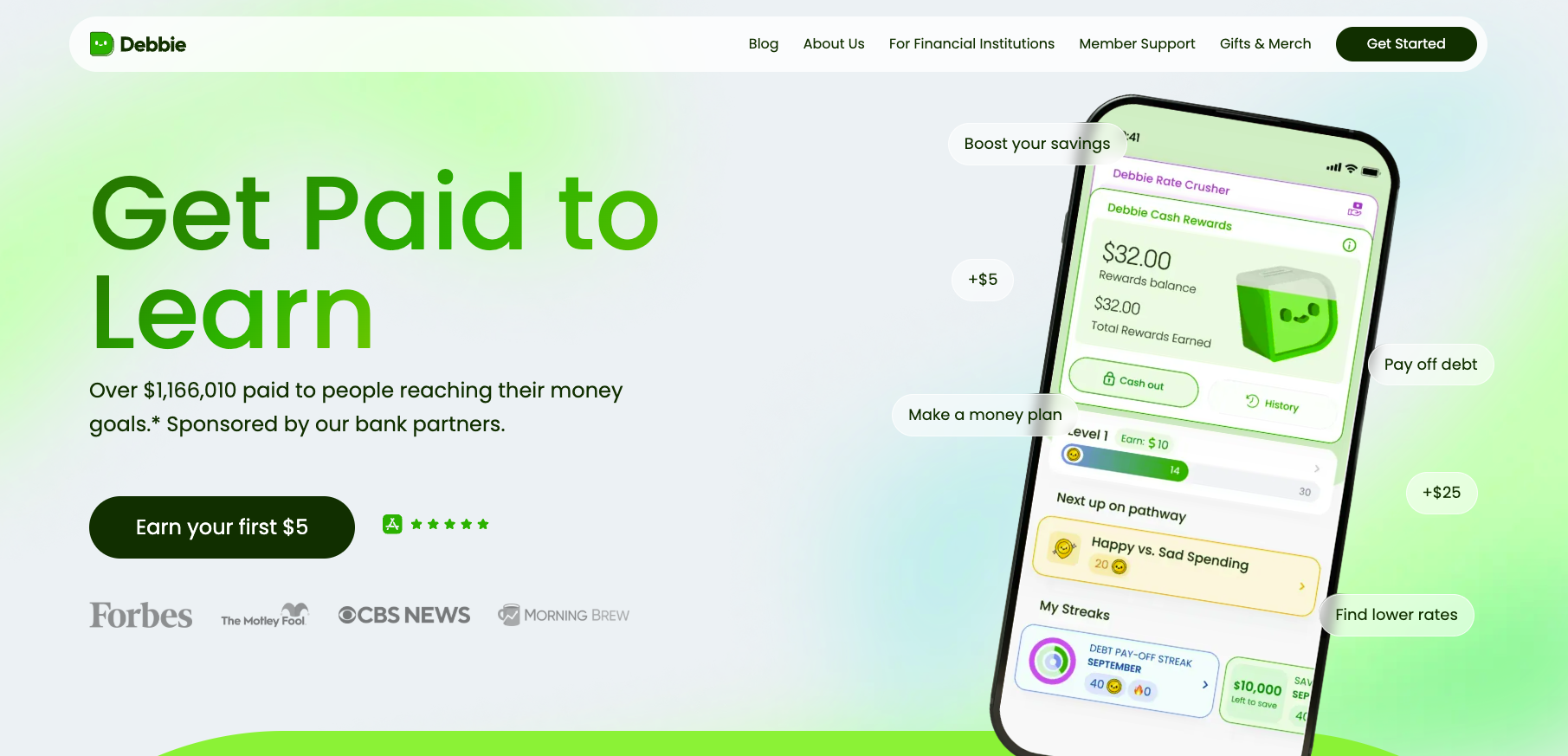

Debbie It is a fintech application that flips the scenario on cash rewards. Most rewards apps give you points when you spend money, but Debbie rewards you for hitting debt payoff and savings goals. And it does it all for free.

Supported by Credit Union PartnersDebbie focuses on helping her users improve their financial mindset and make lasting changes in how they manage their money. In this review, we’ll explain how Debbie works to help you decide if it’s worth using.

What is Debbie?

Debbie is a cash reward app co-founded by two immigrants and college friends, Frieda Lebowitz and Rachel Loren. Freda explains that the idea behind Debbie came from her personal experience with crushing debt and frustration at the lack of options for young people struggling with high-interest debt.

Instead of focusing solely on tools that help you budget, Debbie uses behavioral science, goal setting, and cash rewards to help people stay on track. According to Debbie, users have paid off more than $1 million in debt so far and saved more than $10 million.

What do you offer?

Debbie offers a range of tracking, goal setting, education and rewards tools. Here’s a closer look at its core features.

Tracks your debts and savings

After registering with Debbie, the first step is to link your financial accounts. This allows Debbie to give you a clear picture of your current debt and savings levels. Debbie can help you keep track of credit cards, personal loans, student loans, and emergency savings, all in one app. This makes it very easy to monitor your progress and keep your finances organized.

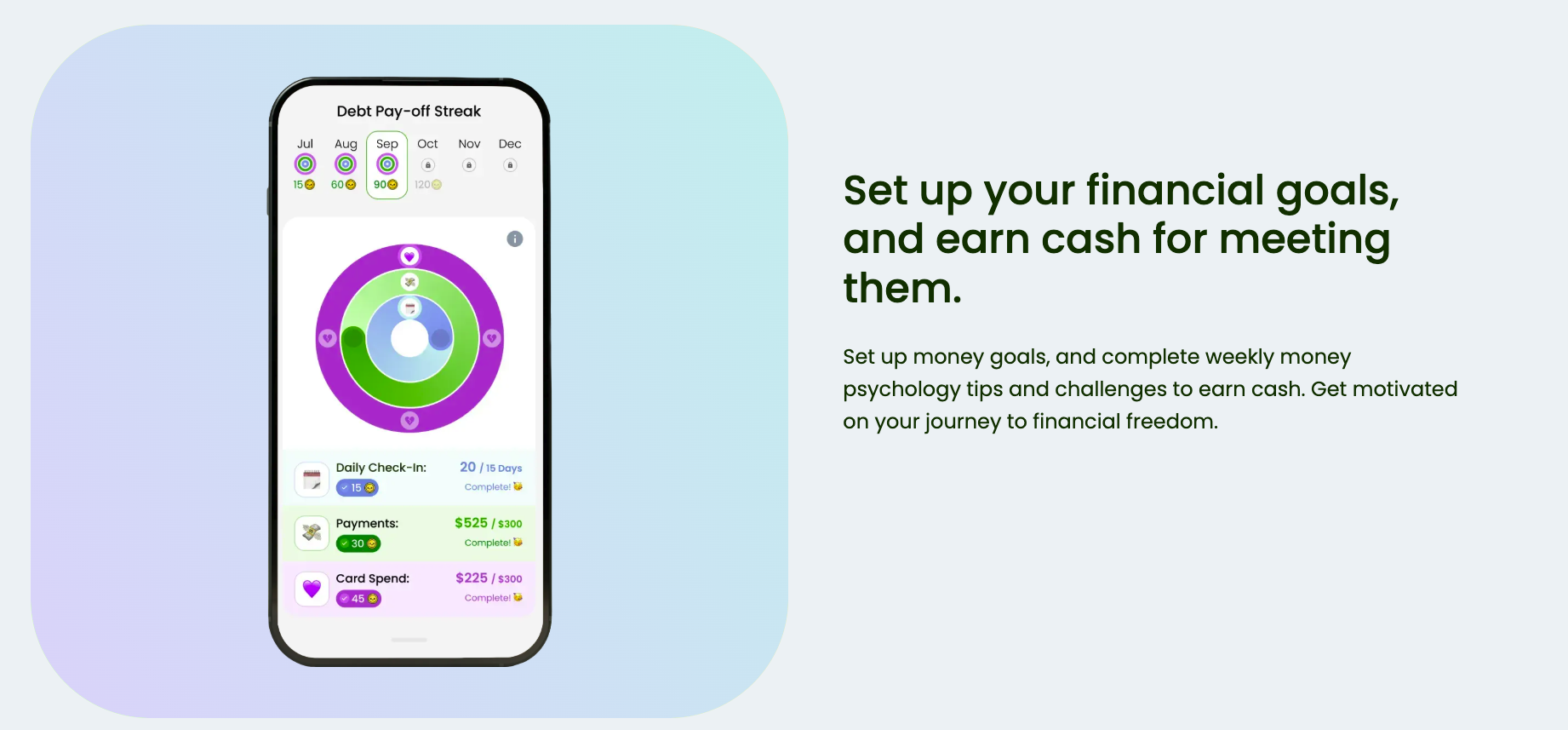

Set financial goals and earn rewards

Debbie allows you to set specific financial goals, such as paying off a credit card or growing your emergency fund. As you progress, the app shares weekly financial psychology tips and challenges. As you complete different milestones, you’ll earn points that you can convert into cash rewards.

Are there any fees?

Debbie is 100% free to use. There are no hidden fees, and you don’t pay Debbie for any additional services.

How does Debbie make money?

Since Debbie is free, you may be wondering how the app makes money. Here’s how to do it:

Debbie cooperates with financial institutions that finance Debbie’s expenses. The catch is that to get your rewards, you need to create a free account with one of these partners. These partners pay a fee to Debbie to provide the Debbie Program.

Debbie then helps you find competitively priced financial products through its partners, and they pay Debbie for the work.

How does Debbie compare?

DebbieIt’s unique in that it pays you cash to pay off debt, but there are other apps that help you save. For example, Walnut Round your purchases to the nearest dollar and automatically invest your spare change. While it focuses more on building investments than paying down debt, it’s a great option if you want to grow your savings without putting in a lot of effort.

stash It is an investment app that does not offer total savings, but allows you to invest automatically with no minimum. There is a monthly fee of $3 or $12, depending on the plan you choose.

head |  | ||

|---|---|---|---|

classification | |||

Pricing | free | $3 – $12 per month | $3 – $12 per month |

Debt Repayment Bonuses | |||

Comprehensive savings | |||

Investment platform | |||

cell |

How can I open an account?

You can sign up for Debbie via her website or mobile app using your phone number. Once verified, your account is automatically created. However, you will need to link to a partner credit union account to unlock your rewards, but Debbie handles that process for you.

Is it safe and secure?

Yes, Debi is safe to use. For starters, it doesn’t hold your money. It simply uses secure connections to connect your different accounts and track your progress. Debbie works with credit union partners, and they also do not have access to your funds and cannot process transactions on your behalf.

How do I contact Debbie?

Debbie does not offer support via phone or physical locations, but you can contact them via email at hello@joindebbie.com. They also have a chatbot that you can ask questions on their website, and you can join Facebook communitywhich includes more than 13 thousand members.

Is it worth it?

If you’re struggling to pay off multiple high-interest credit balances, such as credit cards or a personal loan, Debbie may provide the motivation you need on your journey to debt freedom. Although the bonuses won’t make you rich, the tool is completely free, so there is little downside. Of course, you should be comfortable opening an account with a partner credit union to take advantage of the rewards program.

Debbie features

products | Pay off debt and track savings with cash rewards |

Debt Repayment Bonuses | Yes |

Monthly fees | no |

Investment | no |

Branches | no |

Availability of ATM machines | no |

Customer service email | hello@joindebbie.com |

Availability of mobile applications | iOS and Android |

Web/desktop account access | Yes |

Direct deposit | no |

Pay the bill | no |

Promotions | no one |

Reviewed by: Robert Farrington

The article Debbie Review: Get a Bonus for Paying Off Debt appeared first on The College Investor.