Introduction

The Forex market, known as the world’s largest financial marketplace, is a beacon for traders seeking opportunities to grow their wealth. With daily transactions exceeding $7 trillion, this market promises unparalleled liquidity and profit potential. However, the risks involved can be equally monumental. Success in Forex trading hinges on mastering risk management—a critical skill set that separates consistent winners from those who fail.

This guide, titled “Top Forex Risk Management Techniques Every Trader Should Know,” provides actionable strategies, tools, and insights to help traders navigate the market confidently. By understanding and applying effective risk management principles, you’ll not only protect your capital but also position yourself for sustainable growth.

Also read: Forex Trading Guidelines 2025: Expert Recommendations on Dos and Don’ts

Understanding Risks in the Forex Market

Before implementing risk management techniques, it’s essential to grasp the various types of risks inherent to Forex trading:

Market Risk

Market risk, also known as systematic risk, refers to the potential for an investor to experience losses due to factors that affect the overall performance of financial markets. This type of risk is inherent in all investments and cannot be eliminated through diversification. In the context of the foreign exchange (Forex) market, market risk is particularly significant due to the market’s inherent volatility. Investopedia

Several factors contribute to market risk in Forex trading:

- Interest Rate Risk: Fluctuations in interest rates set by central banks can lead to significant changes in currency values. For instance, an increase in a country’s interest rates may attract foreign capital, causing its currency to appreciate. Conversely, a decrease can lead to depreciation. Forex

- Currency Risk: Also known as exchange-rate risk, this arises from the change in price of one currency in relation to another. Investors or companies that have assets or business operations across national borders are exposed to currency risk that may create unpredictable profits and losses. Investopedia

- Volatility Risk: The Forex market is known for its high volatility, meaning that currency prices can experience rapid and significant changes in short periods. While this volatility can present opportunities for profit, it also increases the potential for substantial losses. Forex

Managing market risk in Forex trading involves implementing robust risk management strategies. Traders should employ tools such as stop-loss orders to limit potential losses and avoid excessive leverage, which can amplify both gains and losses. Additionally, staying informed about global economic events, central bank policies, and geopolitical developments can help traders anticipate market movements and make informed decisions. Investopedia

It’s important to recognize that while market risk cannot be entirely eliminated, understanding its sources and implementing effective risk management practices can help mitigate its impact on trading outcomes.

Leverage Risk

Leverage in forex trading allows traders to control larger positions with a relatively small amount of capital, potentially amplifying profits. However, it equally magnifies losses, making it a double-edged sword. For instance, with a 1:100 leverage ratio, a trader can control $100,000 with just $1,000. While this setup can lead to significant gains if the market moves favorably, even a slight adverse movement can result in substantial losses, potentially depleting the entire trading account. Trading Class

High leverage increases the risk of margin calls, where the broker demands additional funds to maintain open positions. If unmet, the broker may close positions at a loss, leading to significant capital erosion. Additionally, the allure of high leverage can tempt traders into overtrading or taking on excessive risk, often resulting in poor decision-making and emotional trading. FasterCapital

To mitigate these risks:

- Implement Strict Risk Management: Set stop-loss orders to limit potential losses and avoid risking more than a small percentage of your capital on a single trade.

- Use Appropriate Leverage Levels: Opt for lower leverage ratios that align with your risk tolerance and trading strategy.

- Maintain Discipline: Stick to a well-defined trading plan and avoid impulsive decisions driven by market volatility.

By understanding and respecting the power of leverage, traders can harness its benefits while minimizing potential pitfalls.

Liquidity Risk

While the forex market is renowned for its high liquidity, certain events can significantly impact this characteristic, leading to liquidity risk. Geopolitical events, such as conflicts, elections, and policy changes, can create uncertainty and change market sentiment, leading to fluctuations in currency values and increased trading opportunities. Cortiea

Economic announcements, including central bank rate decisions or major geopolitical developments, tend to have a more pronounced effect on liquidity compared to low-impact events. Traders closely monitor these events and adjust their positions, accordingly, leading to increased trading activity and liquidity. Forex Academy

To manage liquidity risk effectively:

- Stay Informed: Keep abreast of global news, economic calendars, and geopolitical developments to anticipate potential market disruptions.

- Use Risk Management Tools: Implement stop-loss orders and position sizing to protect your trades from sudden shifts in market sentiment due to geopolitical events. Cortiea

- Be Cautious During Major Events: Consider reducing or hedging positions ahead of significant economic announcements or geopolitical events to mitigate potential adverse effects on liquidity.

By understanding the factors that influence liquidity and employing prudent risk management strategies, traders can navigate the challenges posed by liquidity risk in the forex market.

Interest Rate Risk

Interest rate risk in forex trading arises from fluctuations in interest rates between two currencies, which can significantly influence exchange rates. Central banks adjust interest rates to manage economic factors like inflation and growth, and these changes can lead to unexpected market movements. Investopedia

Impact of Interest Rate Changes:

- Currency Appreciation: An increase in a country’s interest rates often attracts foreign investors seeking higher returns, leading to an appreciation of that country’s currency.

- Currency Depreciation: Conversely, a decrease in interest rates may result in investors moving their capital elsewhere in search of better yields, causing the currency to depreciate.

Interest Rate Differentials:

The difference in interest rates between two countries, known as the interest rate differential, is a key factor in forex trading. Traders often engage in carry trades, borrowing in a currency with a low-interest rate and investing in one with a higher rate to profit from the differential. However, sudden changes in interest rates can disrupt these strategies and lead to significant losses. babypips.com

Managing Interest Rate Risk:

- Stay Informed: Regularly monitor central bank announcements and economic indicators to anticipate potential interest rate changes.

- Diversify: Avoid overexposure to a single currency pair, especially those sensitive to interest rate fluctuations.

- Use Hedging Strategies: Employ financial instruments like options or futures to hedge against adverse movements resulting from interest rate changes.

By understanding and managing interest rate risk, traders can make more informed decisions and mitigate potential negative impacts on their forex trading activities.

Credit Risk

Credit risk in forex trading refers to the possibility that a counterparty, such as a broker or financial institution, may fail to fulfill their financial obligations, leading to potential losses for traders. This risk is particularly pronounced when dealing with unregulated brokers or counterparties.

Risks Associated with Unregulated Brokers:

- Lack of Investor Protection: Unregulated brokers operate without oversight from financial regulatory authorities, meaning they are not bound by stringent rules designed to protect investors. In cases of insolvency or fraudulent activities, traders may find it challenging to recover their funds. Forex Wink

- Potential for Fraud: Without regulatory scrutiny, unregulated brokers may engage in unethical practices such as price manipulation, refusal to process withdrawals, or even misappropriation of client funds. FinanceBrokerage

- Limited Recourse: In disputes with unregulated brokers, traders often have minimal legal avenues to pursue, as there is no governing body to enforce fair practices or mediate conflicts. 55brokers

Mitigation Strategies:

- Choose Regulated Brokers: Opt for brokers regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). These regulators enforce standards that enhance transparency and accountability.

- Conduct Due Diligence: Research a broker’s reputation, regulatory status, and financial stability before engaging in trading activities. Look for reviews, regulatory filings, and any historical issues that may raise concerns.

- Monitor Account Activity: Regularly review account statements and transaction histories to detect any irregularities promptly. Immediate action can mitigate potential losses arising from counterparty defaults.

By exercising caution and engaging only with regulated and reputable brokers, traders can significantly reduce credit risk and protect their investments in the forex market.

Understanding these risks forms the foundation of any effective risk management strategy.

Essential Forex Risk Management Strategies

Leverage Control

Leverage is a powerful tool in trading that allows you to control larger positions with a smaller amount of capital. While it can amplify profits, it also increases the potential for significant losses. To use leverage wisely, consider the following tips:

- Start Small: If you’re new to trading, begin with minimal leverage (e.g., 1:10) to understand market dynamics and manage risk effectively. Medium

- Adjust Exposure: Most brokers offer leverage control options. Utilize them to match your risk tolerance and avoid overexposure. Elevate Trading Skills

- Monitor Margin Levels: Maintain a healthy margin level, typically above 50%, to avoid margin calls. Regularly monitor your margin to ensure it meets the broker’s requirements. TradingKit

- Use Stop-Loss Orders: Implement stop-loss orders to automatically close positions at predetermined levels, limiting potential losses. Elevate Trading Skills

- Diversify Your Portfolio: Spread your investments across different asset classes to mitigate risk and reduce the impact of market volatility. FasterCapital

- Stay Informed: Keep abreast of market conditions and economic news to make informed decisions and adjust your leverage accordingly. FasterCapital

By following these guidelines, you can use leverage responsibly and enhance your trading strategy.

Stop-Loss Orders

A stop-loss order is a fundamental risk management tool in trading that automatically closes a position when it reaches a predetermined price, thereby limiting potential losses. Investopedia

Strategic Placement of Stop-Loss Orders

To effectively utilize stop-loss orders, it’s essential to place them based on thorough analysis:

- Technical Analysis: Employ chart patterns, support and resistance levels, and other technical indicators to identify optimal stop-loss points. For instance, setting a stop-loss just below a significant support level can be effective for long positions. Small Business Sense

- Fundamental Analysis: Consider underlying economic factors, company performance, and industry trends that might influence price movements. This approach helps in setting stop-loss levels that align with the asset’s intrinsic value. Small Business Sense

- Volatility Considerations: Adjust stop-loss levels to account for market volatility. In highly volatile markets, wider stop-losses may be necessary to prevent premature exits, while in stable markets, tighter stops can be more appropriate. Small Business Sense

Dynamic Adjustment of Stop-Loss Orders

As market conditions evolve, it’s prudent to adjust your stop-loss orders to reflect new information and price movements:

- Trailing Stops: Implement trailing stop-loss orders that automatically adjust as the market price moves in your favor, locking in profits while still protecting against potential reversals. Techopedia

- Regular Review: Continuously monitor market conditions and adjust your stop-loss levels accordingly to maintain effective risk management. This practice ensures that your stop-loss orders remain aligned with current market dynamics. Small Business Sense

By strategically placing and dynamically adjusting your stop-loss orders, you can enhance your trading discipline and protect your investments from significant losses.

Diversification

Diversification is a fundamental risk management strategy in forex trading that involves spreading your investments across various currency pairs to mitigate potential losses. By diversifying, you reduce the impact of adverse movements in any single currency pair on your overall portfolio.

Mix It Up: Trade a Combination of Major, Minor, and Exotic Currency Pairs

- Major Currency Pairs: These pairs involve the most traded currencies and typically offer high liquidity and lower spreads. Examples include EUR/USD, GBP/USD, and USD/JPY. Trading major pairs provides stability and predictability.

- Minor Currency Pairs: Also known as cross-currency pairs, these exclude the US Dollar and include pairs like EUR/GBP, GBP/JPY, and AUD/CHF. They offer exposure to different market dynamics and can be useful for diversification.

- Exotic Currency Pairs: These involve currencies from emerging or smaller economies, such as USD/TRY (US Dollar/Turkish Lira) or EUR/ZAR (Euro/South African Rand). While they can offer higher returns, they also come with increased risk due to lower liquidity and higher volatility.

By incorporating a mix of these pairs, you can achieve a well-rounded portfolio that balances risk and reward. Clicksure

Avoid Correlation: Choose Pairs with Low Correlation to Prevent Simultaneous Losses

Understanding the correlation between currency pairs is crucial for effective diversification. Currency pairs can exhibit positive, negative, or neutral correlations:

- Positive Correlation: Two currency pairs move in the same direction. For example, EUR/USD and GBP/USD often move together because both involve the US Dollar.

- Negative Correlation: Two currency pairs move in opposite directions. For instance, EUR/USD and USD/CHF often move inversely.

- Low or No Correlation: Two currency pairs move independently of each other.

By selecting currency pairs with low or negative correlations, you can reduce the risk of simultaneous losses. This means that if one pair moves unfavorably, others in your portfolio may not be affected in the same way, helping to balance potential losses. Clicksure

Incorporating these strategies into your trading approach can enhance your portfolio’s resilience and improve your risk-adjusted returns.

Position Sizing

Position sizing is a critical component of effective risk management in trading, determining how much capital to allocate to each trade. Proper position sizing helps minimize the impact of individual losses on your overall portfolio, contributing to long-term trading success.

Risk Percentages: Risk Only 1-2% of Your Trading Capital Per Trade

A widely recommended approach is to risk only 1-2% of your trading capital on each trade. This conservative strategy ensures that a series of losses won’t significantly deplete your account, allowing you to continue trading and learning from each experience. For example, if you have a $25,000 account and decide to risk 2% per trade, you would risk $500 on each trade. Investopedia

Consistent Application: Apply the Same Risk Parameters to Every Trade for Consistency

Consistency in applying your risk parameters across all trades is essential. By maintaining the same risk percentage, you create a predictable risk profile, which aids in evaluating the effectiveness of your trading strategy over time. This disciplined approach helps prevent emotional decision-making and supports long-term trading success. Trading Strategies You Always Need

Calculating Position Size Based on Risk

To determine the appropriate position size, consider the following factors:

- Account Risk: The amount of capital you’re willing to risk on a single trade.

- Trade Risk: The difference between your entry price and your stop-loss price.

- Position Size: The number of units (e.g., shares, contracts) to buy or sell.

For instance, if you’re willing to risk $500 on a trade and your stop-loss is $20 below your entry price, you would calculate your position size as follows:

- Position Size = Account Risk ÷ Trade Risk

- Position Size = $500 ÷ $20 = 25 units

This calculation ensures that your potential loss aligns with your predefined risk tolerance. Investopedia

By adhering to these principles of position sizing, you can manage risk effectively, preserve capital, and enhance the consistency of your trading performance.

Emotional Discipline

Emotional discipline is crucial in trading, as it significantly influences decision-making and overall performance. Emotional decisions often lead to costly mistakes. To enhance emotional discipline, consider the following strategies:

Follow a Plan: Develop a Comprehensive Trading Plan and Adhere to It

A well-structured trading plan serves as a roadmap, outlining your goals, strategies, risk management techniques, and criteria for entering and exiting trades. Adhering to this plan reduces impulsive decisions driven by emotions. By following a plan, you can make decisions based on predefined rules rather than emotional reactions to market movements. moneracap.io

Take Breaks: Step Away When Emotions Run High, and Reassess Your Strategy with a Clear Mind

Recognize when emotions like fear, greed, or frustration are influencing your decisions. Taking regular breaks from trading can help you maintain a clear and focused mindset. Avoid overtrading, which can lead to burnout and increased emotional stress. By taking breaks and limiting the number of trades you make, you can prevent emotional exhaustion and stay disciplined in your approach. moneracap.io

By implementing these strategies, you can cultivate emotional discipline, leading to more rational decisions and improved trading outcomes.

Tools and Technology for Risk Management

Trading Journals

Maintaining a trading journal is a vital practice for traders aiming to enhance their performance and achieve consistent success. By systematically documenting and evaluating your trades, you can identify patterns, recognize strengths and weaknesses, and refine your strategies.

Record Details: Note Entry/Exit Points, Trade Rationale, and Outcomes

For each trade, include the following information:

- Date and Time: Document when the trade was executed.

- Instrument Traded: Specify the asset or security involved.

- Entry and Exit Points: Record the exact prices at which you entered and exited the trade.

- Position Size: Note the number of units (e.g., shares, contracts) traded.

- Trade Duration: Indicate how long the position was held.

- Reason for Trade: Explain the rationale behind entering the trade, including any technical or fundamental analysis that informed your decision.

- Outcome: Detail the result of the trade, including profit or loss, and calculate the return on investment (ROI).

- Emotional State: Document your emotions and mindset before, during, and after the trade.

This comprehensive record provides a clear picture of your trading activities and decision-making processes. Elevate Trading Skills

Analyze Results: Regularly Review Past Trades to Refine Strategies

Consistently reviewing your trading journal allows you to:

- Identify Patterns: Detect recurring behaviors or outcomes in your trades, such as consistent profits or losses under specific market conditions.

- Evaluate Strategies: Assess the effectiveness of your trading strategies by comparing planned actions with actual outcomes.

- Learn from Mistakes: Recognize common errors or deviations from your trading plan and develop corrective measures.

- Monitor Emotions: Analyze how your emotions influenced your trading decisions and implement strategies to manage psychological factors better.

By systematically analyzing your trades, you can refine your strategies, enhance your trading discipline, and improve overall performance. The 3F

Incorporating these practices into your trading routine can lead to continuous improvement and greater consistency in your trading endeavors.

Risk Management Software

Leveraging technology can significantly enhance your risk management practices in trading. Utilizing specialized tools can streamline the process of determining optimal position sizes and allow you to practice risk management strategies effectively.

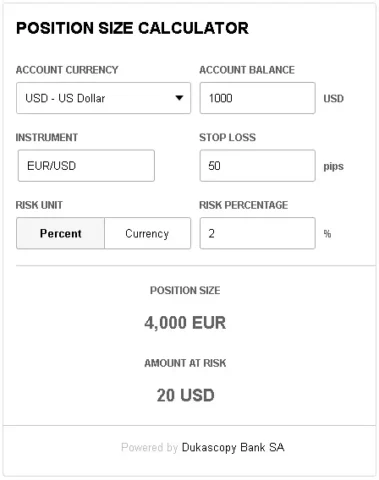

Position Calculators: Determine Optimal Position Sizes Based on Account Size and Risk Tolerance

Position size calculators are essential tools that help you calculate the appropriate amount of capital to allocate to a single trade, ensuring that your risk per trade aligns with your overall risk management plan. By inputting variables such as account balance, risk percentage, and stop-loss levels, these calculators provide precise position sizes to manage risk effectively.

Here are some recommended position size calculators:

Babypips Position Size Calculator

A user-friendly tool that allows traders to input their account balance, risk percentage, and stop-loss in pips to determine the optimal position size. babypips.com

TraderLion Position Size Calculator

This calculator helps traders determine position sizes based on account size, risk percentage, and stop-loss levels, aiding in effective risk management. TraderLion

Dukascopy Position Size Calculator

A comprehensive tool that calculates position sizes in units of the base currency, considering account balance, risk percentage, and stop-loss in pips. Dukascopy

Simulation Platforms: Practice Risk Management Strategies Using Demo Accounts

Simulation platforms, often available through demo accounts, allow you to practice and refine your risk management strategies without financial risk. These platforms simulate real market conditions, enabling you to test various scenarios and adjust your strategies accordingly.

By integrating these technological tools into your trading routine, you can enhance your risk management practices, leading to more disciplined and informed trading decisions.

Automated Trading Systems

Automated trading systems (ATS) are designed to execute trades based on predefined criteria, effectively removing emotional biases from trading decisions. By programming these systems with specific risk parameters, traders can ensure consistent application of their strategies.

Rule-Based Execution: Program Automated Systems with Your Risk Parameters

Automated trading systems operate by following a set of predefined rules and algorithms. Traders can program these systems to execute trades based on specific criteria, such as technical indicators, price movements, or other market conditions. This rule-based execution ensures that trades are carried out consistently and without emotional interference. Wikipedia

Periodic Updates: Regularly Monitor and Adjust Algorithms to Align with Market Conditions

While automated systems can operate independently, it’s essential to periodically review and adjust the algorithms to ensure they remain effective under current market conditions. Regular monitoring allows traders to make necessary adjustments, optimizing the system’s performance and aligning it with evolving market dynamics. sygnal.ai

By integrating automated trading systems into your trading strategy, you can achieve greater consistency, discipline, and efficiency, leading to more informed and objective trading decisions.

Educational Resources for Risk Management

Continuous learning is crucial for mastering Forex risk management. Explore these resources:

Books and Courses

Enhancing your trading knowledge through reputable resources can significantly improve your skills and understanding of market dynamics. Here are two highly recommended resources:

1. “Japanese Candlestick Charting Techniques” by Steve Nison

This comprehensive guide delves into the art of Japanese candlestick charting, a pivotal tool for analyzing price action in financial markets. Steve Nison, a pioneer in introducing candlestick charting to Western traders, offers in-depth insights into various candlestick patterns and their applications. The book includes numerous examples and charts, making complex concepts accessible to both beginners and experienced traders. PenguinRandomhouse.com

2. BabyPips Courses

BabyPips offers a structured educational platform suitable for traders at all levels. Their “School of Pipsology” provides free, comprehensive courses covering a wide range of topics, from the basics of forex trading to advanced strategies. The courses are designed to be engaging and informative, with interactive quizzes and practical examples to reinforce learning.

By exploring these resources, you can build a solid foundation in trading principles and techniques, enhancing your ability to navigate the complexities of the financial markets.

Online Platforms and Communities

Engaging with online platforms and communities can significantly enhance your trading knowledge and connect you with experienced traders. Here are two prominent communities to consider:

1. Forex Factory

Forex Factory is a comprehensive platform offering a wealth of resources for traders, including:

- Forums: Engage in discussions on various trading topics, share strategies, and seek advice from seasoned traders.

- Economic Calendar: Stay updated with real-time economic events and news that impact the forex market.

- Market Data: Access live market data and analysis to inform your trading decisions.

By participating in the Forex Factory forums, you can gain valuable insights and connect with a community of traders who share their experiences and strategies. Forex Factory

2. Reddit’s Forex Community

Reddit hosts a vibrant forex community where traders discuss various aspects of forex trading:

- r/Forex: A subreddit with over 200,000 members, covering topics such as technical analysis, trading strategies, and market news.

- r/ForexSignals: A community where traders share and discuss forex trading signals, providing opportunities to learn from others’ analyses.

- r/AlgorithmicTrading: Focuses on the development and implementation of trading algorithms, ideal for those interested in automated trading.

Engaging with these subreddits allows you to participate in discussions, ask questions, and gain diverse perspectives from traders worldwide. redditmedia.com

By actively participating in these communities, you can enhance your trading skills, stay informed about market trends, and connect with like-minded individuals who share your trading interests.

Video Resources for Forex Risk Management

Enhancing your understanding of risk management in forex trading through visual resources can be highly beneficial. Here are some recommended video tutorials and courses that focus on key aspects of risk management:

Performance Optimization and Risk Management for Trading

This Udemy course offers a comprehensive approach to trading performance and risk management, covering topics such as position sizing, leverage optimization, and the effective use of stop-loss orders. It provides practical insights and coding exercises to help you apply these concepts in real-world scenarios. Udemy

Definitive Guide to Position Sizing Strategies

Offered by the Van Tharp Institute, this resource delves into position sizing strategies, emphasizing the importance of determining the optimal amount of capital to risk per trade. It provides in-depth analysis and practical applications to enhance your trading discipline. Van Tharp Institute

Is Forex Buy-and-Hold Trading the Investing Strategy You’ve Been Missing?

This article from Investopedia explores the buy-and-hold strategy in forex trading, discussing its advantages and risks. It offers insights into how this approach can be integrated into your trading plan and the importance of risk management in its application. Investopedia

By engaging with these resources, you can deepen your understanding of risk management principles and learn how to apply them effectively in your trading practice.

Conclusion

Forex trading offers incredible opportunities but comes with inherent risks. By applying the techniques outlined in “Top Forex Risk Management Techniques Every Trader Should Know,” you can mitigate these risks and trade with confidence. Remember, risk management isn’t a one-time task but an ongoing process requiring discipline and adaptability.

Start implementing these strategies today to protect your investments and achieve long-term success in the Forex market.

Frequently Asked Questions (FAQs)

What is the first step in effective Forex risk management?

Understanding the types of risks, such as market and leverage risks, is the first step.

How does leverage impact risk?

Leverage amplifies both gains and losses, making it crucial to use leverage conservatively.

Why are stop-loss orders essential?

Stop-loss orders limit potential losses, ensuring trades are closed at predetermined levels.

Can emotional trading be avoided?

While emotions can’t be eliminated, adhering to a trading plan minimizes their impact.

How does position sizing help in risk management?

Position sizing controls the capital risked per trade, protecting your account from significant losses.