The company’s financial health is extremely important to its success, which makes the role of high performance financing team a very important. The presence of financial experts can provide a feature that translates into a better decision, improve efficiency, and promotes profitability.

A team with a suitable mix of skills and experience guarantees that financial strategies are in line with work goals, which is essential for movement in market fluctuations and long -term sustainability. Giving priority to developing a strong financing team can pave the way for innovative solutions that meet the unique challenges facing the economy.

The importance of financial experience

Financial experience extends beyond merely breaking the numbers. It includes data analysis to extract meaningful visions that push the work strategy. A financing team full of qualified professionals can explain the complex financial regulations and market trends, allowing institutions to make enlightened decisions.

A strong financing team plays a pivotal role in prediction and balance, and serves as the backbone of strategic planning. With accurate expectations based on quantitative data and market research, companies can customize resources more effectively.

Financial experts are adept at identifying potential risks and can implement controls to reduce them. This pre -emptive approach contributes to a strong framework for risk management, which increases financial stability.

Build a high -performance financing team

Top Talent is one of the first steps in building an effective financing team. The comprehensive recruitment process guarantees that the candidates have the correct qualifications and that they are in line with the organizational culture. Use a Financial Services Employment Agency This process can be simplified and firm companies with high -caliber financing specialists who have the right mix of skills. These agencies often have large -scale networks in the latest standards of industry, which facilitates quickly qualified candidates.

Attracting individuals with various backgrounds can lead to new views of the financing team. Skills in data analyzes, risk assessment and strategic planning are crucial. It complements these technical skills with soft skills, such as communication and teamwork, a more round team that is able to address multi -faceted issues. Focusing on diversity and integration can enhance innovation, which enables the difference to move in challenges more effectively and enhance performance.

Continuous training and development

Once there are a financial team, continuous professional training and development activities are vital to maintaining high performance. The financing industry develops rapidly, with technological developments and organizational changes that require adaptation. Regular Upskilling guarantees that the team members are currently with these developments, making them more valuable to the organization.

Guidance programs and professional certificates courses can play an important role in employee growth. Encouraging team members to pursue certificates such as CPA or CFA enhances their experience and enhances the credibility of the team. Investing in teaching your team prepares them for the future and signals for employees until their growth is a priority. This can significantly affect functional satisfaction rates.

Take advantage of technology in financing

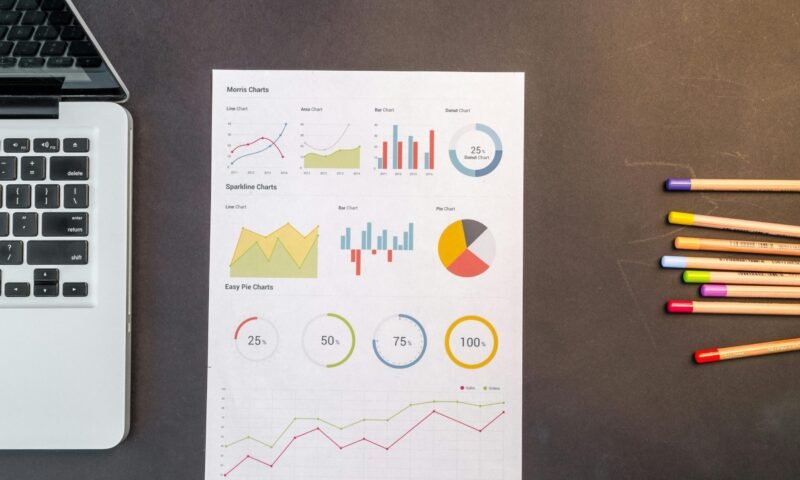

Integration of advanced technology in financing processes can significantly enhance productivity and accuracy. The automation tools reduce the time you spend in worldly tasks, allowing the team members to focus on more strategic initiatives. Implementation of the cloud Financial management Systems improve cooperation and provide actual time access to financial statements through departments.

Adopting advanced analyzes and artificial intelligence can increase the financing function. By taking advantage of these technologies, the teams can extract visions from large data groups, automatically automatically automate and determine directions that may not be visible. The financing team equipped with the latest technology provides a competitive advantage, enabling organizations to respond quickly to market changes and customer requests.

Leadership role in financing

Strong driving within the financing team is very important to align the financing strategies with the business goals. The financing leader must have an ideal finance and the ability to communicate effectively and inspire teamwork. They must enhance a culture of transparency and encourage open discussions about the financial performance and the challenges facing the team.

By promoting accountability and a feeling of ownership among team members, financial leaders can create a favorable environment for high performance. Regular performance reviews and constructive comments can stimulate employees, which improves continuous improvement. The common understanding of the organization’s financial goals creates a unified approach, which facilitates the implementation of strategies that drive business forward.

Measuring success and performance

Creating major performance indicators (KPIS) is very important to measure the effectiveness of financing teams. Standards such as prediction accuracy, budget change, and return on investment help measuring the team’s performance and identifying areas of improvement. Reviewing these main performance indicators regularly allows financing leaders to control strategies and ensure the compatibility of financial operations with wider work goals.

Creating a comments episode where the financial teams can share visions and recommendations that promote a continuous improvement mentality. Inclusion with other departments can stimulate cooperative problems solutions, improve resource customization and enhance operational efficiency. Understanding these dynamics and creating open communication methods can enhance the role of the financing team as a vital contribution to the company’s success.

Raising your business through high -performance financing team requires strategic employment, continuous development and integration of modern solutions. By focusing on financial experience, developing with technology, promoting leadership and strong communications, institutions can create a strong financing function that pays business growth. As institutions continue to face new challenges, it would be better for the equipped with a skilled financing team in a better mode for movement and prosperity within the complexities of the market.