Key points

- You usually have up to 3 years to amend your tax return to fix errors.

- Use Form 1040-X to report the changes to the IRS.

- You must include any changed forms (W-2, 1099, 1098-T).

You filed your taxes and later discovered a missing W-2 number, a late 1099, or an education credit you didn’t claim. If this happens, you can correct it by filing Form 1040-X, which is called amending your tax return. The steps are straightforward once you know what the IRS expects and how the timing works.

The guide below walks you through the most common situations young people face and what to do next.

What is amending a tax return?

Amending a tax return is the process of correcting a tax return you have already filed. Most people choose to file an amended tax return when they realize they could get a larger refund based on an error they made during the filing process. Some people must file amended returns based on IRS notices. These types of adjustments usually come with taxes due.

The IRS allows people to correct their mistakes (and get back the money they overpaid) by filing an IRS Form 1040-X.

To correct problems with your tax return, you generally must file an amended return within three years from the date you filed your original return or two years from the time you paid taxes for that year. If you paid your 2012 tax return on March 1, 2023, you have until March 1, 2026 to file your amended tax return.

Why should you amend your tax return?

The main reason to amend a return is to correct an error that affects the amount of tax due in a particular year. An amended return may result in additional taxes due or a larger refund.

Some of the main issues that could potentially affect the amount due include:

- The deposit status is incorrect.

- Claiming an incorrect number of dependents.

- Changes in your gross income (including deductions from business income if you forget to deduct legitimate business expenses).

- Claim tax deductions or credits that you did not originally claim.

The IRS also rarely issues changes to the tax law so late (or even retroactively) that you might want (or need) to amend your tax return. Over the past few years, this has become increasingly common.

When do you file an amended tax return?

You have three years from the original filing date to file an amended return. You don’t want to wait months, but you also don’t want to file too early.

The IRS warns that people who expect a refund from their original tax return should not file an amended return until after they have received their expected refund.

How to amend a tax return

Just as we recommend using tax software to file your regular tax return, we recommend using tax software to file your amended tax return. The only way to submit your amended tax return electronically is to use a tax software product.

Each tax software has slightly different steps, but these are the general steps you need to follow to amend your tax return.

Step 1: Gather the correct documents

To file your amended tax return, you will need your original tax return and any documents that support the changes to the tax return. To get your original tax return, you can either access the return through your tax software (you’ll usually have access for a year or more) or you can have your tax return Tax transcript from the IRS.

Aside from your original return, you will need documents to support the change you make to your tax return. For example, a parent claiming an additional child as a result of a child custody settlement needs proof of the final settlement.

Those claiming forgotten credits or deductions may need receipts to support their claim. If you forget to claim part of your income, you will likely need a 1099-NEC, W2, or other 1099 source to support the change.

Step 2: Choose how to file your 1040-X

It is theoretically possible to prepare a 1040-X by hand and mail it. However, we recommend using a CPA or tax software to do the heavy lifting for you.

Filers who used a CPA for the tax year they are amending should talk to their CPA about the cost structure. You may be able to enlist the CPA to file an amended return at no or limited cost, especially if the CPA was supposed to discover the problem.

If you choose to use tax software, we typically recommend using whatever software you used to originally file your tax return. For example, if you used FreeTaxUSA to file your 2025 tax return, you must use FreeTaxUSA to amend your 2025 tax return.

Step 3: Complete the 1040-X

To complete your amended return, you will need to follow the instructions from the tax software product of your choice. These are instructions from some of the most well-known tax companies.

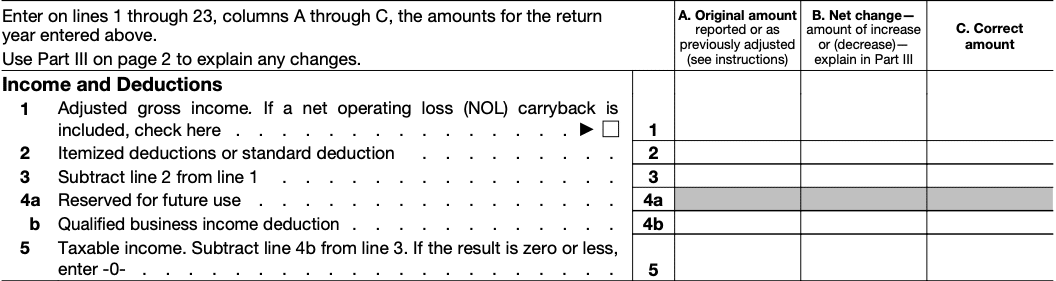

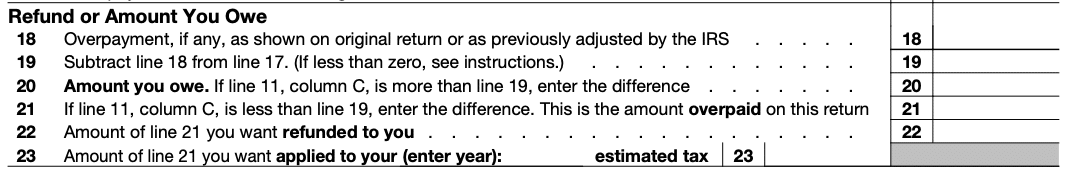

Form 1040-X has only three main columns that must be filled out. Column A shows the amount you originally reported on the 1040. Column B shows the net changes (both positive and negative) and Column C shows the correct amount.

Once you fill out the basic information associated with your income and deductions, you can easily calculate the correct refund amount.

Most major tax software offers step-by-step instructions to help filers accurately complete their amended returns. The program asks questions about what has changed so users can resubmit their information more accurately.

Step 4: Submit the 1040-X with supporting information

The IRS supports electronic filing using tax software products such as the ones listed above.

People who want to fill out a 1040-X without a tax program must mail their returns and supporting documents to the IRS. People who choose to amend their returns themselves should email them to:

Ministry of Treasury

Internal Revenue Service

Austin, TX 73301-0215

If you are amending your return based on instructions from the IRS, mail the return to the address specified in the official IRS notice.

Remember you need to file with the IRS Form 1040-X Any changed tables or forms support the change.

Step 5: Track status

You can track the status of your amended return using Tax Authority website. During peak tax filing season, amended returns may take… 16 weeks or more To process. Unless there is some type of error on your return, the IRS will eventually return your money to you.

Instructions

Can I amend my return if I forgot to include a 1098-T?

Yes. Add education information, update account balance, attach forms, and file Form 1040-X.

Can I fix my submission status?

Yes, as long as the state you switch to is the state you were eligible for on your original application date.

Can I amend if I forgot to report gig income?

Yes. Add the missing 1099-NEC or 1099-K and review any related deductions.

Can I edit if I never applied?

No, if you have not filed, submit the original return instead. Form 1040-X is only intended to correct returns that have already gone to the IRS.

Does the amendment affect financial aid verification?

If your school uses IRS verification, you may need updated information once the IRS processes the amendment. Contact the financial aid office to confirm their steps.

Can I file an amended return electronically?

Typically yes in recent years, depending on software and IRS rules. Check your software platform to ensure eligible years.

Final thoughts

It can be frustrating to find out that you left money on the table by making a mistake on your taxes. But the IRS allows tax filers to get back money they rightfully own. You probably won’t want to spend your file Saturday afternoon preparing your return, but doing so could result in hundreds or even thousands of dollars worth of additional refunds.

Although filing documents is difficult, it will likely be worth it to get the money you are owed.

Editor: Robert Farrington

Reviewed by: Claire Tuck

The post How to File an Amended Tax Return appeared first on The College Investor.