Key points

- The Rule of 72 helps you estimate how long it will take your money to multiply quickly at a fixed annual return.

- Tariffs and inflation can sharply extend this timeline – the “true” doubling rate is often lower than you think.

- It is a shortcut, not a replacement for a financial calculator – accuracy drops at rates that are too high or too low.

The Rule of 72 is a mental arithmetic shortcut that tells you how long it takes to double an investment.

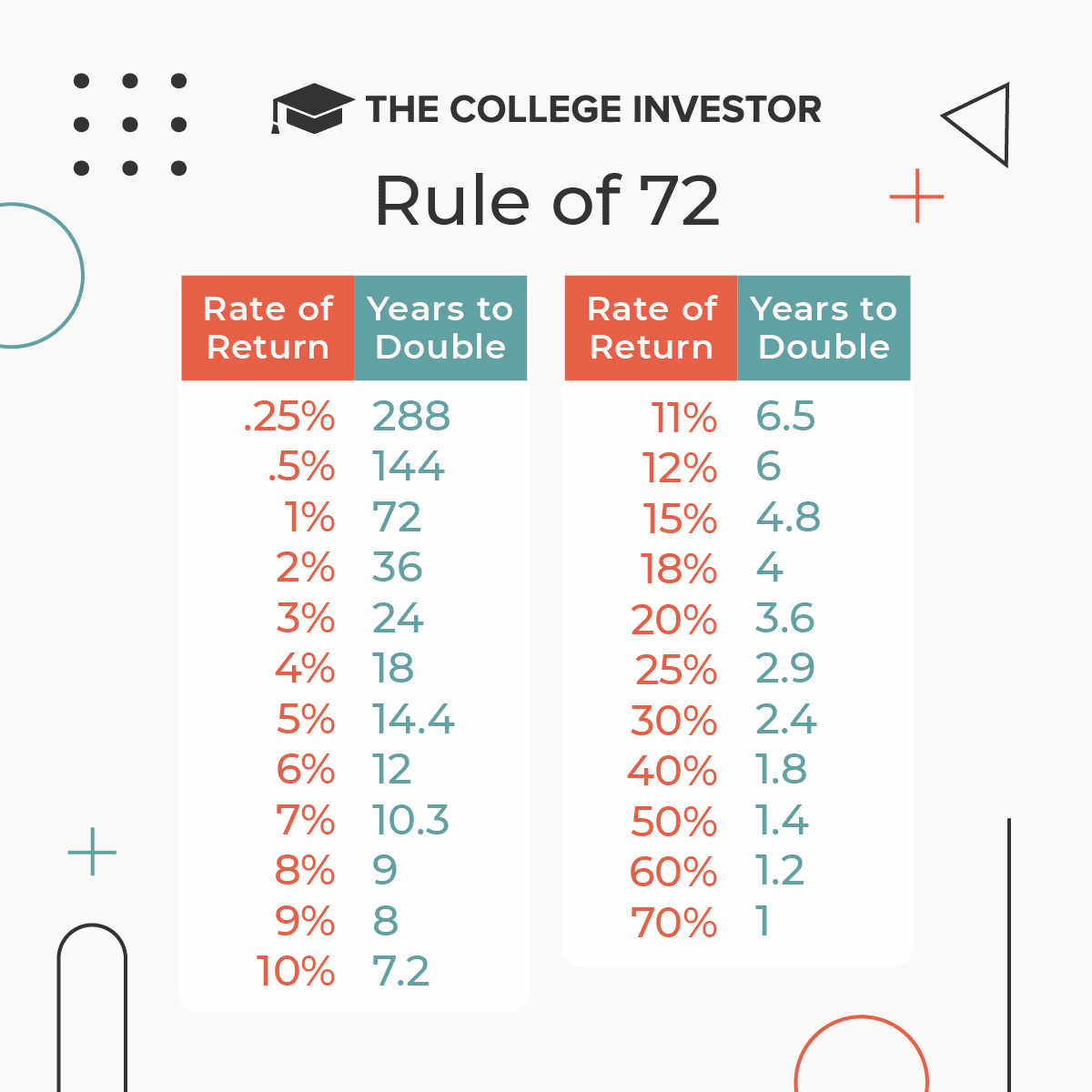

Take 72 and divide it by the annual percentage return. The result is the approximate number of years needed to double your money.

example:

- If you expect an annual return of 8%, then 72 ÷ 8 = 9 years.

- At 6%, it takes 12 years.

It’s fast, practical and surprisingly close to reality for moderate rates of return (between 4% and 15%).

Rule 72 applicable to investment

Now that you know the basics of the Rule of 72, you may be wondering why you should care about it? I mean, how does that help with investing? We all want our money to double as quickly as possible.

I use the Rule of 72 in two scenarios when it comes to investing:

1. Effect of fees:If you want to know how much money your fees will take from your investments, you can take the base 0f 72 and divide it by the fee rate. This will show you how many years it will take for fees to consume half of your investment. For example, if you have a mutual fund that charges 2%, it would take 36 years to cut the fee in half if the money didn’t grow. How about that scary?

2. Effect of inflation:You can also use the Rule of 72 to quickly estimate the impact of inflation on your portfolio (or better, the purchasing power of your portfolio’s earnings). For example, if the inflation rate is 3%, it will take 24 years for one dollar to reach $0.50. You can use this to help you plan your retirement spending. If you plan to retire in 24 years, you’ll need double your current expenses to live on inflation.

Related to:Would you rather have a penny that doubles every day or $1,000,000?

Other rules

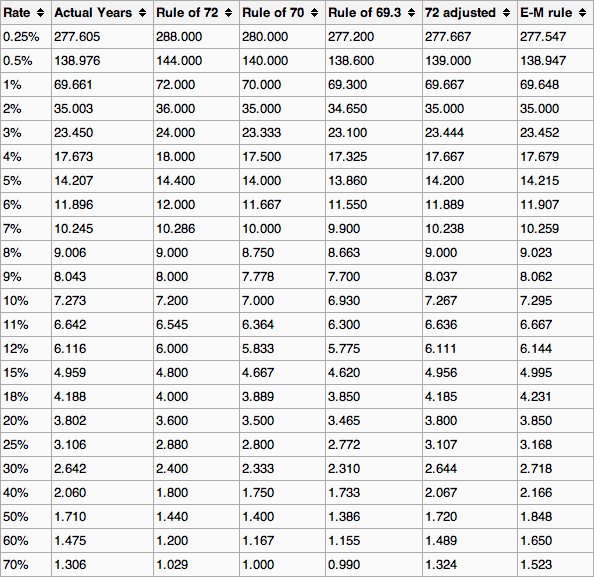

It is important to note that the rule of 72 is just an estimate. In fact, using the 2% example above, your money would effectively double in 35,003 years. This is why some people prefer to use a base of 70 or a base of 69. In fact, if you have a continuous composition, it is the base of 69 in the base that you want to use.

To make things easier, we found this great chart from Wikipedia Which highlights the rules in action:

Instructions

Q: Does the Rule of 72 produce negative returns?

No, it only applies to positive growth rates. A -2% return means you are shrinking, not doubling.

Q: Can I use it for inflation?

Yes. Divide 72 by the inflation rate to find out how long it would take purchasing power to halve. For 3% inflation, 72 ÷ 3 = 24 years – prices roughly double in 24 years.

Q: Is this true for savings accounts?

It’s close for savings accounts, but at very low interest rates (less than 2%), the 70 rule is a little better.

Q: What is the rule of 69 and rule of 70?

They are slight variations that are better suited to continuous compounding (Rule of 69) or low-rate scenarios (Rule of 70).

Q: Can the rule help in comparing investments?

Yes. Use it to estimate how fees, inflation, or yield changes at the time of compounding – helping you focus on growth after fees and after inflation.

Final thoughts

The formula works because it approximates the compound interest formula. At daily growth rates, 72 is a constant that is easy to remember and makes mental estimates simple.

They’re especially useful for long-term savers who want to measure how rate or fee changes affect outcomes without pulling out a spreadsheet.

Don’t miss these other stories:

Best Passive Income Ideas for Building Wealth in 2025

How to start investing in your 30s: Tips for 30-39 year olds

How to Make a Million Dollars – Successful Maths and Strategies

Editor: Clint Proctor

Reviewed by: Chris Mueller

The post Rule of 72 Explained: This Chart Will Estimate How Fast Money Grows appeared first on The College Investor.