Key points

- The average credit score in the United States held steady at 701 points, down one point from a year ago, indicating a slight decline in borrower credit quality.

- Mortgage delinquency rates rose to their highest level in five years, while credit card payments remained stable.

- Consumers continued to borrow cautiously, with balances rising but utilization rates remaining steady.

Latest CreditGauge report from VantageScore It shows that US consumers entered the fall of 2025 with slightly strained credit files. The national average VantageScore 4.0 remained steady at 701, unchanged from August but one point lower than September 2024.

VantageScore describes this as a “sign of normalization” after a year of increased borrowing and repayment activity. Although balances continue to rise (largely driven by rising mortgage and auto loan values), credit utilization rates have remained steady, indicating that most consumers are managing debt responsibly despite rising borrowing costs.

Would you like to save this?

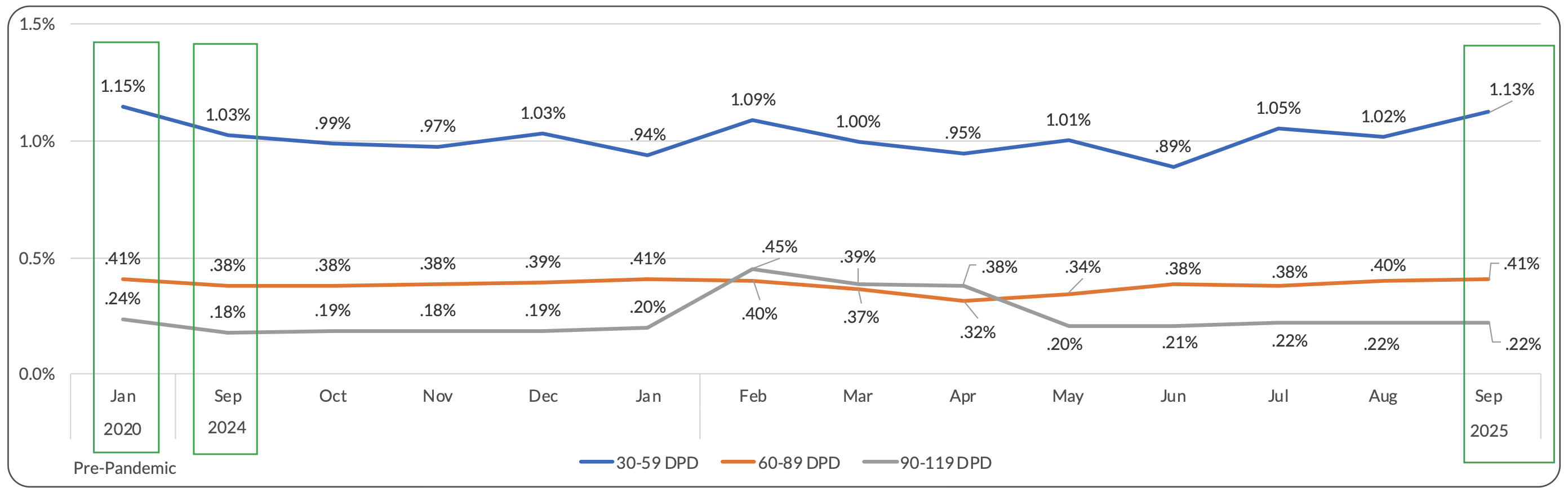

Deviations are trending toward pre-pandemic levels

Delinquency rates rose modestly in September, led by mortgage accounts, which saw the largest year-over-year increases across all delinquency stages. Overall, the 30- to 59-day delinquency rate rose to 1.13%, up from 1.02% in August and approaching pre-pandemic levels of 1.15%.

Source: VantageScore

Late-stage anomalies (90-119 DPD) remained at 0.22%, unchanged for the third month in a row but higher than last year. Mortgage delinquencies rose in every category, including a 12.7% jump in early-stage delinquencies and a 7.6% increase in late-stage delinquencies.

Even consumers with traditionally higher credit scores have shown signs of stress. Among prime borrowers (661-780), late-stage delinquencies were up 54% from last year, while near-prime borrowers (601-660) saw a 44% rise. In contrast, prime mortgage consumers (781-850) saw a slight improvement, suggesting that lower-risk borrowers remain relatively resilient.

Increase balances across products

Average balances rose across most credit products. Typical consumer load $106,500 in total credit balancesan increase of 1.3% over last year and almost to record levels. However, the balance-to-loan ratio remained roughly constant at 50.79%, indicating stable utilization patterns.

By category:

- Mortgage balances It rose by 2.8% to $270,300Reflecting rising house prices and interest rates.

- Car loans middle $24,700an increase of 1.7% year-on-year.

- Personal loans inches up to $17,400with the balance-to-loan ratio 70.9%.

- Credit card balances Slightly decreased to $6400and its benefit decreased 30.68%This indicates restricted revolving credit usage as households prepare for the holiday season.

Younger borrowers remain the most active participants in new credit:

- Gen. Z Personal loans (4.4%) and credit cards (4.2%) led but saw a slowdown in mortgage activity (1.42%, down from 1.57% in August).

- Millennials Follow them closely, and maintain constant participation in all categories.

- Older generations (incl Boomers and silent generation)Borrowers remained less active, especially in unsecured credit.

What it means for consumers

Despite the modest loosening of credit, the data suggest that Americans maintain control of their debt.

However, a rise in mortgage delinquencies and a drift toward lower credit levels could indicate pressures are growing beneath the surface. Borrowers with adjustable-rate mortgages or large auto loans may feel the squeeze as payments continue to rise.

Families can take several steps to protect their credit:

- Monitor and benefit from balances To stay under 30% of available credit.

- Prioritize on-time paymentsBecause early delinquencies remain the leading indicator of credit deterioration.

- Consider refinancing Or consolidation options if monthly payments increase due to higher interest rates.

The September 2025 credit gauge shows the economy is in a delicate balance: Consumers are managing, but rising loan volumes and an uptick in delinquencies point to fatigue after years of high borrowing costs.

As the holiday season approaches, households are cautious – spending steadily but avoiding overextension.

Don’t miss these other stories:

23 Ways to Earn Extra Cash for Christmas

The best credit building tools to boost your credit scores

How to get a free credit score report

Editor: Colin Greaves

The post US credit scores hold steady as delinquencies rise appeared first on The College Investor.