How Python-like architecture and transparent pricing make TakeProfit a compelling alternative for cryptocurrency traders and developers

TradingView serves over 100 million traders worldwide with cutting-edge charting tools and a massive community library. However, for developers building custom indicators, the platform represents a major hurdle: Pine Script, a proprietary scripting language that requires a significant investment of time to master. While Pine Script is undeniably powerful, it requires Python developers to learn an entirely new syntax just to visualize their trading ideas on charts.

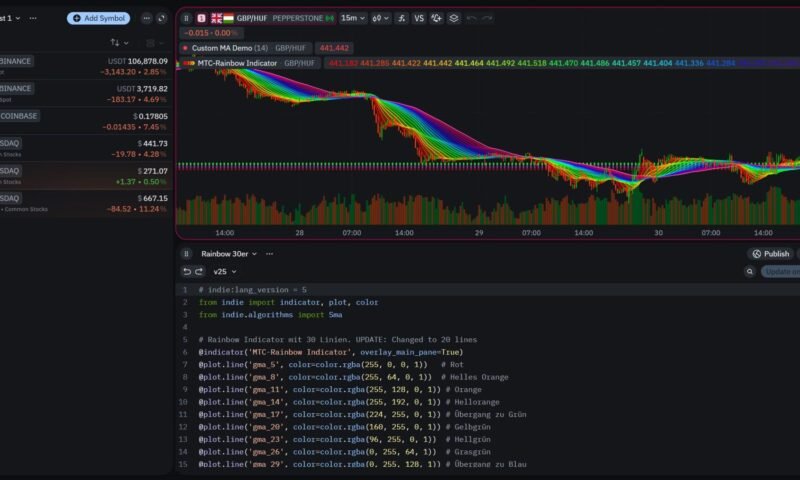

This learning curve has sparked a growing interest in TradingView alternatives, especially among Python developers and cryptocurrency traders who spend more time wrestling with unfamiliar syntax than actually developing trading strategies. He enters TechProfit And its Indie Script language: a cryptocurrency-focused trading platform that offers a Python-like syntax for building custom indicators.

Why are developers looking for TradingView alternatives?

The search for TradingView alternatives stems from three interconnected frustrations: the proprietary language barrier, rising subscription costs, and concerns about platform limitation.

Invest in learning the Payne script

Pine Script represents a non-trivial time commitment. Achieving basic proficiency typically requires 20 to 40 hours of focused study—time spent learning syntax rules, debugging special error messages, and mentally translating Python logic into Pine Script conventions. For Python developers who already understand technical analysis concepts and can prototype indicators in Pandas or NumPy, this represents pure overhead.

The deeper issue is not difficulty, but portability. Pine Script skills remain exclusively valuable within the TradingView ecosystem. It doesn’t translate to backtesting frameworks like Backtrader or VectorBT, it doesn’t appear in quantitative finance job descriptions, and it offers no advantage when collaborating with data science teams using Jupyter notebooks.

The economics of subscriptions

TradingView’s tiered pricing creates uncertainty for developers. The platform works on a structure where features that were available on lower plans are increasingly moved to premium tiers. Custom trend alerts require paid subscriptions, with plans up to $14.95 per month (Basic), $33.95 per month (Plus), $67.95 per month (Premium), and $239.95 per month (Ultimate) when billed monthly. Annual billing offers savings: $12.95 per month for Essential, $28.29 per month for Plus, $56.49 per month for Premium, and $199.95 per month for Ultimate – but these costs still exceed the budgets of many indie developers.

Cryptocurrency Challenge

For cryptocurrency traders specifically, TradingView’s architecture exposes its traditional financial assets. Multi-exchange analysis – comparing Bitcoin prices across Binance, Coinbase and Kraken simultaneously – requires workarounds. Indicators designed for market hours of 9:30 AM to 4:00 PM do not clearly translate to 24/7 cryptocurrency trading patterns.

Top TradingView Alternatives Worth Considering

TrendSpider She excels at automated technical analysis, using artificial intelligence to identify chart patterns. It is especially valuable for swing traders who need the help of an algorithm in detecting setups across multiple time frames.

Quivin Targeted at professional analysts with institutional-level market analysis tools, it excels at fundamental data visualization and comparative analysis across securities.

TakeProfit with indie script It is narrowly focused on reducing friction for Python developers building custom indicators for cryptocurrencies. This specialization — Python-like syntax, transparent fixed-rate pricing, and multi-exchange cryptographic data as core features — sets it apart from general-purpose platforms.

Best TradingView Alternative for Python Developers: Indie

TakeProfit’s value proposition focuses on a clear premise: developers who already know Python shouldn’t need to invest dozens of hours learning proprietary syntax just to build custom trading indicators.

Python-like syntax feature

Text language independent It’s not pure Python – it’s a domain-specific language built for the TakeProfit platform that deliberately mirrors Python syntax conventions. Developers cannot import arbitrary Python libraries, but they gain syntactic knowledge that significantly reduces cognitive load during cursor development.

Structure uses Python decorators that any developer will recognize, imports data according to standard Python conventions, and writes hints that provide safety nets when working with financial accounts. Function definitions use the familiar keyword. Object-oriented patterns are consistent with Python’s approach.

Python developers have reported generating the first comprehensive standalone (not basic demo) cursor in an hour or two. The equivalent learning curve for Pine Script typically spans several days as developers absorb not only new APIs but fundamentally different syntax patterns.

Crypto-native architecture

TakeProfit’s original cryptocurrency approach manifests itself in practical ways. Multi-exchange data integration pulls real-time prices from Binance, Coinbase, Kraken and other major venues simultaneously, enabling cross-exchange arbitrage analysis and volume quantification. The platform assumes 24/7 market operations instead of treating weekend trading as marginal situations.

Developer experience design

The platform has more than 60 built-in technical analysis algorithms – SMA, EMA, RSI, MACD, Bollinger Bands and ATR – which serve as ready-to-use tools and educational examples. The code editor runs entirely within the browser with syntax highlighting and intelligent error checking.

Backward compatibility receives explicit guarantees: indicators written today will work in future platform versions through automatic conversion. Access to support includes direct Discord communication with the engineering team rather than ticket-based systems.

The freedom to publish even extends to free tier users: developers can share pointers with the community regardless of subscription status.

TradingView vs TakeProfit: Features Comparison

| ability | TradingView | TechProfit

|

|---|---|---|

| Development language | PineScript (Proprietary) | Indie script (like Python) |

| Focus on the primary market | Multi-asset | Native cryptocurrency with US equity coverage |

| Pricing (monthly) | $14.95 – $239.95 (Multi-Tier) | $0 – $20 (2 levels: free/paid) |

| Annual cost | $155.40 – $2,399.40 | $0 – $120 |

| Backtest the strategy | Built-in strategy tester | In development |

| Community size | 100+ million users | A smaller and growing community |

| Multi-exchange data | limited | Native support |

| Custom indicators | 2 indicators are available in the free plan and 5-50 in the paid plans | Two indicators are available on the free plan and unlimited on the paid plans |

Where TradingView maintains the advantages

The TradingView community of over 100 million users has created thousands of publicly available indicators and strategies, creating an extensive knowledge base. Built-in strategy testing provides the comprehensive testing capabilities that serious algorithmic traders need. The depth of charting functionality reflects years of improvement.

The pricing range provides entry points for various budgets. The Basic plan at $14.95 per month (or $12.95 per month when billed annually) is comparable to TakeProfit’s paid tier, making it more accessible to price-sensitive traders who need basic paid features.

TakeProfit offers compelling alternatives

The advantages of TakeProfit are most apparent to Python developers building cryptocurrencies who value rapid prototyping over comprehensive feature sets. The syntax similar to Python reduces the time needed for throughput dramatically – from weeks to hours.

Pricing transparency eliminates subscription creep concerns. At $20 per month ($120 per year), TakeProfit’s all-in pricing means no features carry over. Crypto-native architecture offers practical advantages for crypto-focused traders, with multi-exchange data as the core infrastructure rather than an afterthought.

Honest restrictions

The lack of built-in backtesting is the most significant current limitation. While Indie Script excels at visualizing indicators and real-time analysis, developers cannot yet define strategy entry and exit rules or run historical simulations within the platform.

The size of the community library reflects TakeProfit’s relative youth. The TradingView ecosystem has thousands of shared indicators overall, while TakeProfit’s smaller user base means fewer examples available.

Market coverage is deliberately focused on cryptocurrencies with support for US stocks as a secondary function. International exchanges and forex pairs beyond cryptocurrency crosses and futures have limited coverage.

When TradingView is still better

Developers should consider sticking with TradingView if they need to do extensive strategy testing right away, if their trading is primarily focused on traditional assets rather than cryptocurrencies, or if they need access to TradingView’s massive community script library.

Likewise, traders who are already proficient in Pine Script and who have invested dozens of hours mastering the language must carefully weigh the switching costs against the potential benefits.

When TakeProfit Makes Strategic Sense

TakeProfit is a natural fit for Python developers entering algorithmic cryptocurrency trading who want to leverage existing skills rather than spending weeks learning proprietary syntax. Traders frustrated by the uncertainty of subscription cost find TakeProfit’s flat rate of $20 per month refreshingly predictable – total annual costs will never exceed $120 (if paid annually) or $240 (if paid monthly).

Cryptocurrency professionals who require cross-exchange analysis and a native understanding of the microstructure of the cryptocurrency market will find that TakeProfit’s architecture aligns with their operational reality.

Never

The free tier of the platform provides full indicator development capabilities. Visit TakeProfit.com, create an account (no credit card required), and add the Ticker Code Editor tool to your workspace. The browser-based editor provides syntax highlighting and real-time error checking.

Start with a simple indicator – a basic moving average – to experience how Python-like syntax is. The platform documentation at docs.takeprofit.com includes quick-start tutorials and comprehensive library references covering all 60+ built-in algorithms.

Allocate 30 minutes to understand the platform interface and 1 hour to build your first indicator. This two-hour investment provides enough experience to judge whether familiarity with the syntax speeds up the development process compared to Pine Script.

conclusion

TakeProfit’s bet on Python-like syntax, crypto-native architecture, and transparent fixed pricing addresses the real frustrations Python developers face when creating cryptocurrency indices. For this specific intersection — developers who know Python, trade cryptocurrencies, and prioritize rapid prototyping — the platform offers measurable benefits in reduced learning curve and development speed.

However, specialization inherently implies trade-offs. Current limitations around backtesting, smaller community libraries, and cryptocurrency-focused market coverage make TakeProfit unsuitable for traders who need comprehensive strategy verification or access to a broad asset class.

The best alternative to TradingView depends entirely on individual circumstances. For Python developers curious to know whether familiar syntax really matters to the speed of cursor development, investing a couple of hours exploring TakeProfit’s free tier provides a tangible experience that’s worth more than just comparative analysis.

Explore TakeProfit at takeprofit.com and evaluate whether developing Python-like indicators fits into your cryptocurrency trading workflow.