- The U.S. Department of Education is deferring wage garnishments and tax refunds on delinquent federal student loans.

- The delay is intended to give borrowers enough time to prepare for the new repayment rules, including the upcoming Repayment Assistance Plan (RAP).

- Defaulted borrowers will now have more time to rehabilitate their loans and emerge from default.

Education management Officially announced today It would delay the start of involuntary collection activity on federal student loans, including administrative wage garnishment and tax refund forfeiture through the Treasury Reimbursement Program. The move follows Education Secretary Linda McMahon’s remarks at a press event and is framed as a transition period before major changes to the federal reimbursement system.

Under current law, borrowers who default on federal student loans can get paid without a court order and have federal benefits or tax refunds withheld. The department said the pause will allow time to implement new repayment plans and give borrowers more time to get out of student loan default.

Why are collections delayed?

Department officials said involuntary collections will resume only after the new system is implemented, arguing that enforcement will work better when borrowers have clearer and more affordable repayment paths.

There is currently no ETA on when collections will resume.

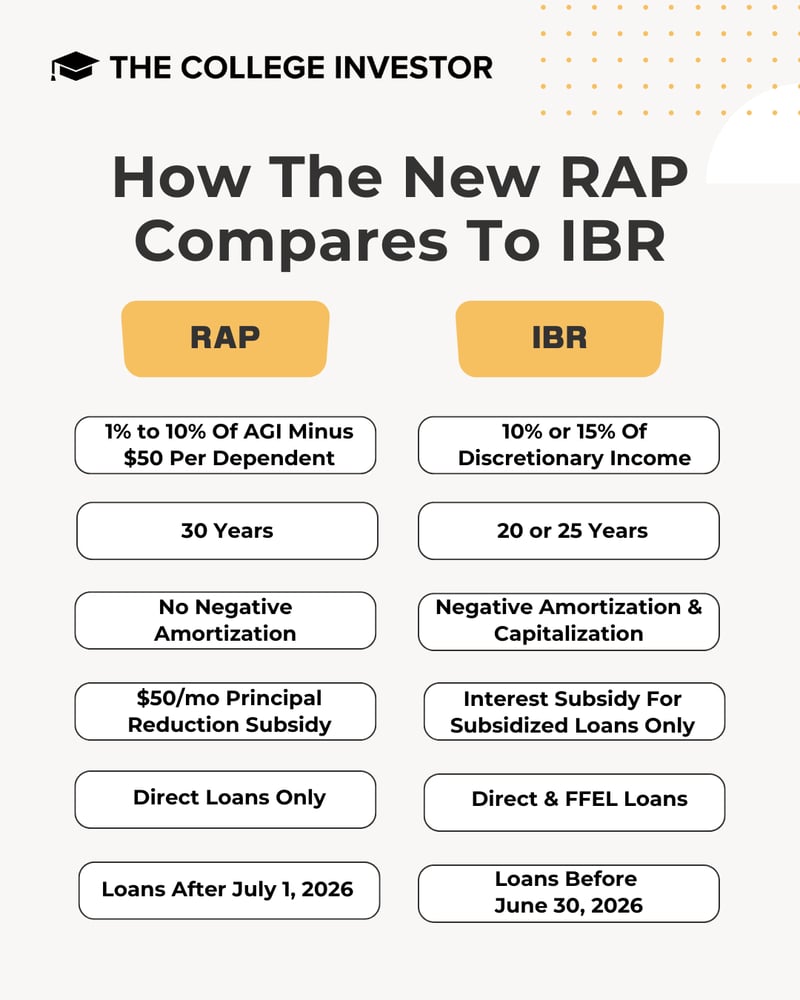

The Big Beautiful Bill Act (OBBBA) dramatically reduces the number of federal repayment plans, replacing what officials described as a confusing array of choices with two basic options: a standard repayment plan and an income-based repayment plan. The ministry says the simplification of the structure is intended to reduce borrower errors and missed payments that can lead to default.

The newly created Repayment Assistance Plan (RAP) is central to these changes. Beginning July 1, 2026, the plan will waive unpaid interest for borrowers who make on-time monthly payments that are too small to cover accrued interest. In some cases, the department will also make small matching payments so that the borrower’s principal balance continues to decrease each month – up to $50 per month.

For borrowers who are already in default, the department said delaying wage garnishment and tax offsets will give them time to consolidate loans or enter into repayment arrangements so they can qualify for those options as soon as they become available.

What this means for student loan borrowers

Issa Kanchola Banez, Policy Director at Protecting borrowersHe says “After months of pressure and countless horror stories from borrowers, the Trump administration says it has abandoned plans to extract workers’ hard-earned money directly from their paychecks and tax refunds simply for defaulting on student loans. In the midst of a growing affordability crisis, the administration’s plans were economically reckless and would have risked pushing nearly 9 million distressed borrowers further into debt. Earlier this month, a coalition of partners sent an urgent letter to the Executive Directorate urging them to do so. We are happy to see that they responded to our prayers.“

However, the moratorium does not erase student loan debt or prevent interest from accruing on defaulted loans. The ministry stressed that non-performing loans will be reported to credit bureaus, which could harm borrowers’ credit scores and affect access to housing, work or other loans.

Borrowers in default are encouraged to contact the Federal Default Loan Servicer to review their options, including consolidation, repayment or rehabilitation agreements. Taking action during delinquency can help borrowers avoid collections once they resume and put them in a position to take advantage of the new repayment framework.

For borrowers who have not defaulted, the announcement does not change existing payment obligations. Regular monthly payments remain due, and existing income-driven repayment plans remain in effect until the new IDR option becomes available in 2026.

What happens next

Borrowers in default should use this window to review their student loan records, check eligibility for rehabilitation, and monitor announcements about the new IDR plan. Consolidating to rehabilitate your student loans now can save you unnecessary costs in the future.

It’s important to remember that Being on a repayment plan is almost always less expensive than defaulting.

The coming months will likely bring more guidance from the administration as it prepares to roll out the new system and determine when garnishments and damages will resume.

Don’t miss these other stories: