In the ever-evolving landscape of digital finance, PayPal has made a groundbreaking move that’s sending ripples through various sectors, particularly the iGaming industry. The launch of PayPal Stablecoin USD (PYUSD), the company’s own stablecoin, marks a significant milestone in the convergence of traditional payment systems and cryptocurrency technology. But what exactly does this mean for online gambling platforms and their users? Let’s dive deep into how PayPal’s stablecoin innovation is reshaping the future of iGaming.

PayPal’s Journey into Cryptocurrency: From Skepticism to Leadership

PayPal’s relationship with cryptocurrencies has undergone a remarkable transformation over the years. Back in 2018, when Bitcoin reached unprecedented heights, PayPal took a surprisingly cautious approach by significantly reducing cryptocurrency transactions on its platform. This decision sent shockwaves through the crypto community, especially as Bitcoin users were celebrating the digital currency’s rising value.

The payment giant’s primary concern was understandable: cryptocurrencies were notoriously volatile, and PayPal wasn’t convinced that the potential benefits outweighed the risks. Despite recognizing the innovative potential of blockchain technology, the unpredictable nature of crypto assets made PayPal hesitant to fully embrace them.

However, the tides have turned dramatically. As cryptocurrencies have matured and demonstrated relative stability over time, PayPal’s stance has evolved. The company now not only facilitates cryptocurrency transactions but has positioned itself at the forefront of digital currency innovation. This strategic pivot reflects PayPal’s recognition that cryptocurrencies are no longer merely speculative assets but increasingly legitimate financial instruments with practical applications.

A Historic Milestone: Customer Crypto Integration

In 2021, PayPal made headlines by announcing that customers could buy, sell, and hold Bitcoin, Ethereum, Litecoin, and Bitcoin Cash directly within their PayPal accounts. This wasn’t just another feature addition—it represented the first international expansion of PayPal’s cryptocurrency services since their initial launch in the United States the previous year.

The integration was designed with simplicity in mind. Customers could now:

- Fund cryptocurrency purchases using their bank accounts or debit cards

- Sell crypto assets with the proceeds immediately available in their PayPal accounts

- Navigate the often complex world of digital currencies through a familiar, trusted interface

For PayPal’s extensive global customer base, this development removed many barriers to cryptocurrency adoption. What was once perceived as a complicated domain reserved for tech enthusiasts became accessible with just a few clicks on a platform millions already used daily.

While cryptocurrency purists might critique PayPal’s centralized approach—particularly the lack of private key access, which limits users’ full control over their digital assets—the development nonetheless represented a significant step toward mainstream crypto adoption.

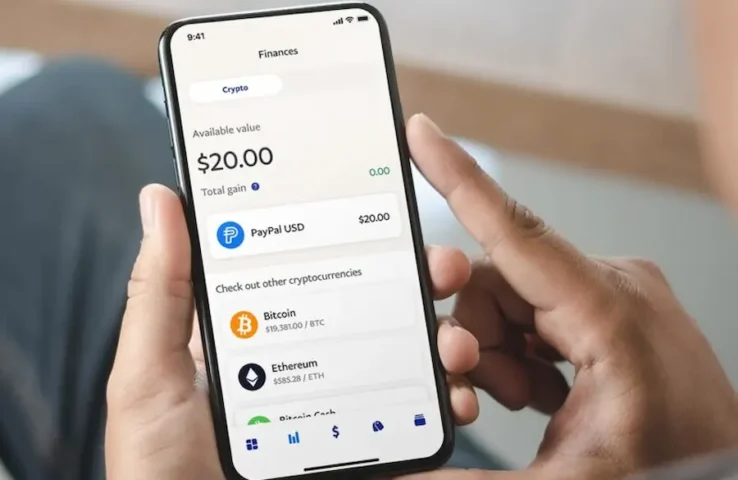

PayPal USD (PYUSD): A Revolutionary Stablecoin

Fast forward to August 2023, when PayPal made history by becoming the first major financial institution in the United States to launch its own stablecoin. Named PayPal USD (PYUSD), this digital currency is designed to address many of the challenges associated with both traditional payment systems and existing cryptocurrencies.

What Makes PYUSD Different?

Unlike volatile cryptocurrencies such as Bitcoin and Ethereum, PYUSD is a stablecoin—a type of digital currency that’s pegged to a stable asset. In PYUSD’s case, it’s backed by:

- US dollar deposits

- US Treasury bills

- Similar cash equivalents

This backing provides crucial stability, effectively eliminating the price fluctuations that have made many merchants and consumers hesitant to adopt cryptocurrencies for everyday transactions.

The Web3 Connection

PYUSD wasn’t created in isolation—it’s specifically designed to revolutionize online transactions within the emerging Web3 ecosystem. By providing frictionless, rapid transactions in virtual worlds and decentralized environments, PayPal aims to:

- Enable developers to create innovative financial applications

- Deliver seamless experiences for customers navigating the digital economy

- Bridge the gap between traditional finance and decentralized platforms

For newcomers to the cryptocurrency space, PYUSD offers an appealing entry point. The stability provided by its dollar backing, combined with the trusted PayPal brand, creates a confidence level that’s often lacking in the broader crypto market.

Strategic Implications

PayPal’s motives behind launching PYUSD extend beyond simply joining the cryptocurrency trend. This move represents a strategic play to solidify the company’s position as a leader in financial services as the world increasingly embraces digital assets.

By leveraging stablecoin technology, PayPal can offer:

- Lower-cost transactions compared to traditional banking methods

- Immediate settlement without central intermediaries

- Enhanced financial inclusion for the unbanked and underbanked populations

- A competitive edge in the rapidly evolving digital payments landscape

Global Adoption of Cryptocurrency Payments

While PayPal makes bold moves in the cryptocurrency space, countries worldwide are reassessing their stance on digital asset integration. Ireland, in particular, has emerged as a frontrunner in crypto-friendly regulation.

The Central Bank of Ireland (CBI) has officially registered fintech companies Ripple and Zodia Markets as Virtual Asset Service Providers (VASPs), signaling the country’s embrace of blockchain technology and cryptocurrency innovation. This regulatory approval places these companies alongside established players like Coinbase, Gemini, and Kraken in Ireland’s growing VASP landscape.

The significance of this development extends beyond mere recognition. These registered entities can now provide crucial services enabling institutional customers in Ireland to engage with the digital asset ecosystem through simplified and secure transactions.

Ireland’s progressive approach to cryptocurrency regulation exemplifies a broader global trend toward accepting and integrating digital assets into mainstream financial systems. This evolving regulatory environment creates fertile ground for innovations like PayPal’s stablecoin to flourish across borders.

PYUSD: A Game-Changer for iGaming

The intersection of PayPal’s stablecoin technology and the online gambling industry presents particularly intriguing possibilities. With PayPal already widely accepted across numerous online casinos and betting platforms, the introduction of PYUSD could fundamentally transform how players deposit, wager, and withdraw funds.

Enhanced Transaction Efficiency

For iGaming enthusiasts, PYUSD offers several compelling advantages over traditional payment methods:

- Faster processing times: Stablecoin transactions can be settled almost instantaneously, eliminating the waiting periods often associated with bank transfers or card payments

- Reduced fees: By bypassing certain intermediaries in the transaction chain, PYUSD could potentially lower the costs associated with moving money in and out of gambling platforms

- 24/7 availability: Unlike traditional banking systems with operating hours and processing delays, cryptocurrency transactions operate continuously, allowing players to fund accounts or withdraw winnings at any time

Stability in a Volatile Market

The stability factor cannot be overstated when considering PYUSD’s potential impact on iGaming. While traditional cryptocurrencies like Bitcoin have been adopted by some gambling platforms, their price volatility creates significant challenges for both operators and players. Imagine winning a substantial amount in Bitcoin, only to see its value drop significantly before withdrawal—or conversely, operators receiving payments that quickly depreciate in value.

PYUSD effectively eliminates this concern by maintaining a consistent value pegged to the US dollar. This stability provides:

- Protection against value fluctuations between deposits and withdrawals

- Predictable transaction values for both players and operators

- Reduced financial risk in an industry already associated with calculated risk-taking

Expanding Market Reach

Perhaps the most significant impact of PYUSD on the iGaming sector lies in its potential to expand market access. PayPal’s massive global user base—numbering in the hundreds of millions—represents an enormous potential player pool for online casinos and betting platforms.

By integrating PYUSD, iGaming operators can tap into:

- An audience already familiar and comfortable with PayPal’s interface

- Users who might have been hesitant to engage with traditional cryptocurrencies due to complexity concerns

- Markets where conventional payment methods for gambling face restrictions or limitations

Regulatory Considerations

The regulatory aspect of PYUSD adoption in iGaming deserves careful attention. As a regulated financial entity, PayPal operates under strict oversight, potentially lending additional legitimacy to gambling platforms that integrate its stablecoin. This could help address some of the regulatory concerns that have traditionally surrounded cryptocurrency use in online gambling.

However, operators will need to navigate varying regulatory requirements across jurisdictions regarding both cryptocurrency acceptance and gambling operations. The integration of PYUSD may necessitate additional compliance measures, but could ultimately contribute to a more transparent and regulated iGaming ecosystem.

The Future Landscape: What Lies Ahead

As PayPal’s stablecoin gains traction, its impact on the iGaming industry is likely to accelerate several emerging trends:

Increased Cryptocurrency Adoption

PayPal’s entry into the stablecoin market legitimizes digital currencies in a way few other developments could. For iGaming operators who have been hesitant to adopt cryptocurrency payment options, PYUSD offers a middle ground—combining the benefits of blockchain technology with the stability and regulatory compliance of a major financial institution.

This could trigger a domino effect, with other payment processors feeling compelled to develop similar cryptocurrency services to remain competitive. The result may be a significant expansion of digital currency options across the online gambling space.

Enhanced User Experience

The integration of PYUSD into iGaming platforms promises to streamline the user experience significantly. Players may soon enjoy:

- Seamless transitions between fiat and digital currencies within a single interface

- Reduced friction in the deposit and withdrawal process

- Greater financial privacy compared to traditional banking methods

- Potential for innovative gameplay mechanics built around blockchain technology

Revenue Growth Potential

Industry analysts project that the adoption of stablecoins like PYUSD could help drive annual revenues for sportsbooks and casino operators to unprecedented levels over the coming years. The combination of expanded market access, improved transaction efficiency, and enhanced user experience creates a powerful foundation for growth.

While full-scale adoption of cryptocurrencies in mainstream commerce remains a longer-term prospect, their legitimacy in specialized industries like iGaming is increasingly undeniable. As major institutions like PayPal embrace blockchain technology, the barriers between traditional finance and digital currencies continue to erode.

The Broader Implications of PayPal Stablecoin

Beyond its immediate impact on iGaming, PayPal’s stablecoin initiative carries significant implications for the broader financial ecosystem:

Bridging Traditional and Decentralized Finance

PYUSD represents an important bridge between the conventional financial system and the emerging world of decentralized finance (DeFi). By introducing a regulated, stable digital asset with the backing of a major financial institution, PayPal helps legitimize the concept of programmable money while mitigating some of the risks and complexities associated with purely decentralized cryptocurrencies.

Financial Inclusion Potential

One of the most promising aspects of stablecoin technology is its potential to extend financial services to underbanked populations. By reducing the need for traditional banking infrastructure, PYUSD could theoretically enable millions of people currently excluded from the financial system to participate in digital commerce—including iGaming where legally permitted.

Setting Standards for Corporate Crypto Adoption

As the first major financial institution in the US to launch a stablecoin, PayPal is effectively establishing benchmarks for how large corporations can responsibly engage with cryptocurrency technology. Their approach—combining innovation with compliance—may serve as a template for other financial institutions looking to enter the space.

Conclusion

PayPal’s stablecoin represents a watershed moment in the convergence of traditional payment systems, cryptocurrency innovation, and the iGaming industry. By addressing the key challenges that have historically limited crypto adoption—namely volatility, complexity, and regulatory concerns—PYUSD has positioned itself as a potentially transformative force in online gambling finance.

For iGaming operators, the message is clear: cryptocurrency adoption is no longer a question of if, but when and how. As PayPal leverages its massive user base and trusted brand to bring stablecoin technology into the mainstream, online casinos and betting platforms that adapt quickly stand to gain significant competitive advantages.

While the collective adoption of cryptocurrencies across all industries remains a journey of years rather than months, their legitimacy and utility in sectors like iGaming are increasingly undeniable. As this technology continues to mature and integrate with established financial systems, we can expect to see unprecedented innovations in how value moves through the digital economy—with PayPal’s stablecoin playing a pioneering role in that evolution.

What are your thoughts on how PayPal’s stablecoin might affect your online gaming experience? Share your feedback in the comments section below, or leave a review of this article. Don’t forget to subscribe for more updates on the intersection of cryptocurrency technology and iGaming!

FAQs

What exactly is PayPal’s stablecoin (PYUSD)?

PYUSD is a digital currency created by PayPal that maintains a stable value by being backed by US dollar deposits, US Treasury bills, and similar cash equivalents. Unlike volatile cryptocurrencies like Bitcoin, PYUSD is designed to maintain a consistent 1:1 value with the US dollar.

How is PYUSD different from Bitcoin and other cryptocurrencies?

While Bitcoin and many other cryptocurrencies experience significant price fluctuations based on market demand, PYUSD is a stablecoin specifically designed to maintain a consistent value. This stability makes it more practical for everyday transactions, including those in the iGaming industry.

Can I use PYUSD at any online casino that accepts PayPal?

Not necessarily. While PayPal is widely accepted at many online casinos, the integration of PYUSD requires specific implementation by gambling operators. As the stablecoin gains popularity, we can expect more iGaming platforms to add support for it alongside traditional PayPal payments.

Are there advantages to using PYUSD over regular PayPal payments for online gambling?

Potential advantages include faster transaction processing, potentially lower fees, 24/7 availability without banking delays, and the ability to easily move funds between different cryptocurrency ecosystems and traditional financial systems.

Is using PYUSD for online gambling legal?

The legality depends on the jurisdiction in which you reside and the specific regulations governing both cryptocurrency use and online gambling in that location. Always ensure you’re complying with local laws before engaging in any form of online gambling or cryptocurrency transactions.

How secure is PYUSD compared to traditional payment methods?

PYUSD benefits from both blockchain security features and PayPal’s established security infrastructure. Transactions are cryptographically secured on the blockchain, while the stablecoin itself is issued by a regulated financial institution with extensive experience in payment security.

Will using PYUSD affect my gambling limits or bonuses?

This will vary by platform. Some iGaming operators may offer special promotions or adjusted limits for cryptocurrency deposits, while others might treat PYUSD identically to fiat currency deposits. Check the specific terms and conditions of your preferred gambling platform.

Sources

- PayPal Newsroom – Official PYUSD Announcement

- Central Bank of Ireland – Virtual Asset Service Provider Registry

- Finance Feeds – Cryptocurrency Regulation Updates

- Crypto Valley Journal – Digital Currency Impact on Gaming

- PayPal’s Cryptocurrency Hub