Paying for college can be stressful, but a clear sequence of steps helps families stretch their resources and avoid taking on unnecessary debt.

Although many students rely on student loans, they should be a last resort. Student loans pile up interest, have long repayment terms, and can put families in financial distress.

At a Glance: How families cover college costs right now

Recent surveys show that college families spent an average of $30,837 during the 2024-25 year. Parents’ income and savings covered about $15,754, and scholarships and grants accounted for nearly a quarter of the total costs. Students also contributed through work, savings and federal aid. Then, of course, student loans.

In reality, study From the OneWisconsin Institute, it takes Wisconsin college graduates 19.7 years to pay off a bachelor’s degree and 23 years to pay off a graduate degree. That’s why you need to understand how much student loan debt you can take on!

In fact, according to the latest statistics on how families pay for college, here’s what that pie looks like in real life:

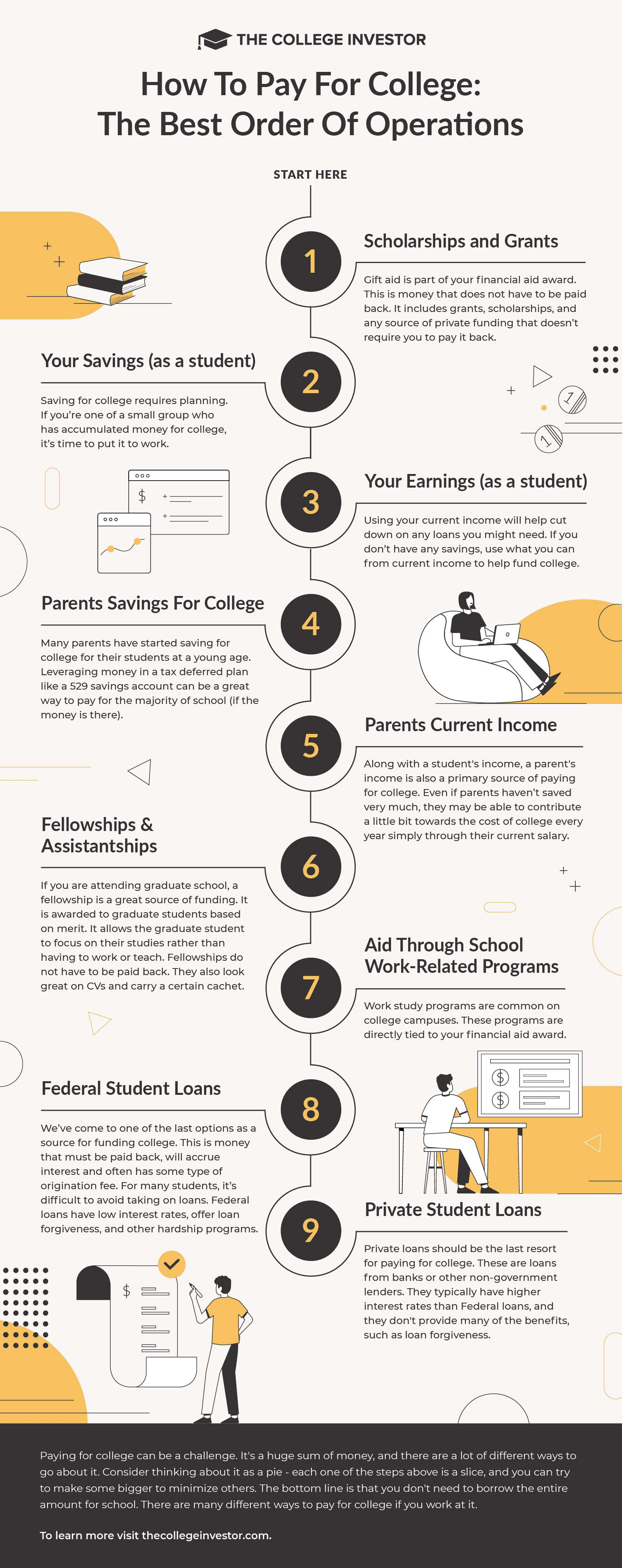

Here’s our take on the “best” order of operations for paying for college. It’s important to note that this is more like a “pie” than a strict command. The more you can contribute from the “previous” tranches, the less you have to borrow. There are no “hard” rules here – but you should definitely use free money before other funds.

The chart below reflects current costs, updated interest rates, and reported financing patterns across U.S. households.

1. Grants and scholarships

Financial aid is part of your financial aid award. This is money that does not have to be repaid. It includes grants, scholarships, and any private funding source that does not require you to repay it.

Of course, this depends on you submitting your FAFSA application on time.

Some students may receive a significant amount of scholarships and grants. Others may not be able to get as much.

Don’t forget to apply for private grants and scholarships too – don’t just rely on your school. This may sound crazy, but I recommend high school students apply to at least 50 scholarships. This is true even if you plan to be a part-time student.

To make it easier, we also have this guide to scholarships and grants by state.

Check out these guides:

- How to Find Scholarships to Pay for College

- How to find grants to pay for college

- Pell Grants: What they are and how to qualify

2. Your own savings (as a student)

Saving for college requires planning. If you’re one of a small group that has raised money for college, now is the time to take advantage of it.

Maybe you’ve been saving your graduation money, or received Christmas money over time. Your grandmother probably left you some money to pay for college when you were younger.

If you have your own student savings, using them to pay for college is a great first step.

3. Your earnings (as a student)

Additionally, using your current income will help reduce any loans you may need. If you don’t have any savings, use what you can of current income to help finance college.

Many people forget that they can earn money before going to school (i.e. best summer jobs for college students), or even work full time while studying.

Personally, I worked full time while studying at university. I worked five days a week – Monday, Wednesday and Friday nights, and during the day on Saturday and Sunday. I try to schedule my classes on Tuesdays and Thursdays, or if necessary, before work on the other days.

Don’t know how to make money as a student? Check out 100+ ways to make money in college.

4. Parents’ savings for college

Next on the list is any money your parents may have set aside for school. This could be in the form of a 529 college savings account, or another savings vehicle.

Many parents start saving for their students’ college education at a young age. Leveraging money in a tax-deferred plan like a 529 savings account can be a great way to pay for the majority of schools (if the money is there).

Parents may also have other savings set aside for their child. It’s important to have conversations about parental contributions early on, so everyone involved in the “paying for college” discussion knows what to expect.

Pro Tip:Here’s our guide to properly structuring your 529 plan distributions.

5. Current income of parents

Besides a student’s income, a parent’s income is also a major source of paying for college. Even if parents have saved a lot, they may be able to contribute a little toward the cost of college each year simply with their current salaries.

Some parents may be able to contribute much more than others, but every small amount that can be sent to avoid borrowing for school is a big win.

Note:Some states give tax deductions or tax credits for 529 plan contributions. You can contribute and withdraw in the same year in most states — which makes it worthwhile to use your current income to contribute to a 529 plan, then pay for college from there.

Check out our guide: 529 plan rules by state.

6. Fellowships and aid

If you are in graduate school, a fellowship is a great source of funding. It is awarded to graduate students on the basis of merit. It allows the graduate student to focus on their studies rather than having to work or teach. Repayment of fellowships is not required. They also look great on resumes and have a certain character.

“It’s basically the Harry Potter scar on your forehead that says you’re a wonderful scientist.”Meredith Drake Reitan saidassociate dean of graduate fellowships at the USC Graduate School.

“The fellowship program is about research potential,” she said. “Faculty might say, ‘They’re not ready to apply for an NSF fellowship because their research isn’t quite mature.’ But that’s actually where the NSF wants it to be — it’s designed to serve as an early career accelerator.”

Takeaway: Don’t think you’re not eligible for the fellowship. They are definitely worth applying for. Talk with your educational counselor or advisor about how and which of them may have the highest potential for successful admission.

7. Assistance through programs related to school work

We continue down the list and get to work-related programs that aim to provide flexible scheduling around your classes. At this point, you have exhausted all forms of financing that do not require labor exchanges or loans. We now turn to the sources of financing that will require some type of recovery.

Work studies are common on campus. These programs are usually tied to your financial aid award. They allow you to work on campus within a flexible schedule. The pay is usually minimum wage, but you can’t beat the flexible scheduling these programs offer. Although it is a smaller source of funding, depending on your semester schedule, it may be the only type of job you can do.

Assistantships are usually reserved for graduate students. These programs are similar to work studies except that they are educational positions. The student often teaches lower level classes in areas he knows well.

Check out our guide to federal work-study programs.

8. Federal student loans

We have come to one last option as a source of college funding. This is money that must be paid back, will accrue interest, and often has some type of origination fee. For many students, it is difficult to avoid taking out loans.

Federal loans have a fairly low interest rate, which often does not exceed the single digits. As reported StudentAid.govLoans first disbursed on or after July 1, 2025 and before July 1, 2026 have the following interest rates:

- Direct Sponsored (Bachelor): 6.39%

- Direct Unsupported (Bachelor): 6.39%

- Direct, unsupported (graduate or professional): 7.94%

- Direct PLUS: (Parents and graduate or professional students): 8.94%

When it comes to college loans, you’re unlikely to find a better deal anywhere else.

Don’t believe us? Check out the best student loan rates here. And remember, fall 2026 rates won’t appear until May 2026.

If you need to get a student loan, here’s the process on how to get a student loan (either federal or private).

9. Private student loans

Private loans are another and final option. These may be loans from banks or other non-government lenders. Interest rates are typically higher than government loans and will not offer the same benefits such as loan forgiveness, hardship options, and flexible repayment plans.

Private student loans should be a last resort, and before borrowing, you should pay them back in full The return on investment of your college expenses Even to see if college is worth it.

We recommend that students shop around and compare private loan options before taking out one.reasonable It’s an excellent option because you can compare about 10 different lenders in two minutes and see what you qualify for. Check credibility here.

You can also see the full list of private student loan options here: Best Private Student Loans.

graph

If you agree with this order of operations, share this helpful infographic with your friends and family who need to know:

Final thoughts

Paying for college can be a challenge. It’s a huge amount of money, and there are a lot of different ways to do it. Even those more expensive colleges have the potential to be significantly more affordable through financial aid.

I like to think of it as a pie – each of the above steps is a slice, and you can try to enlarge some to reduce the size of the others.

The bottom line here is that you don’t need to borrow the entire amount for school. There are many different ways to pay for college if you work in it.

Editor: Clint Proctor

Reviewed by: Ashley Barnett

The article How to Pay for College: The Best Order of Operations appeared first on The College Investor.