A Backdoor Roth IRA It is a strategy that allows high-income earners to bypass the regular income limits on Roth contributions and have money in a Roth IRA.

This Roth strategy is called the “back door” because it involves contributing money that has already been taxed to a traditional IRA. After a few days, the account holder transfers the funds to a Roth IRA. Since the funds have not earned any money, they can be transferred without tax consequences except for the requirement to fill them IRS Form 8606.

For high-income earners, a backdoor Roth may seem like a tax strategy that’s too good to be true. After all, a few clicks of buttons and a single tax form allow high-income individuals to exceed the regular income limits for Roth contributions.

However, this strategy is a reasonable way for high-income earners to protect some of their money from future taxes. Here’s what you need to know about it.

Understand IRA contribution limits

A Roth IRA is an account into which people contribute money that has already been taxed to a retirement account. Once the money is in the account, it becomes tax-free and is not subject to tax when the account holder withdraws the money. The Roth is a great (and legal) tax haven for ordinary investors.

However, The IRS sets limits About who can contribute to a Roth IRA. High-income people are not allowed to contribute directly to the account. For 2026, spouses filing jointly are excluded from the Roth contribution limit if their adjusted gross income is more than $252,000 per year (the phaseout begins at $242,000). For single people, the income cap is $168,000, and the phase-out begins at $153,000.

Traditional IRAs are also a form of individual retirement accounts. Typical account holders can get a tax deduction when they contribute to a traditional IRA. The tax deduction on traditional contributions gradually ends as income rises. However, individuals can still contribute money that is already taxable to a traditional IRA regardless of their income.

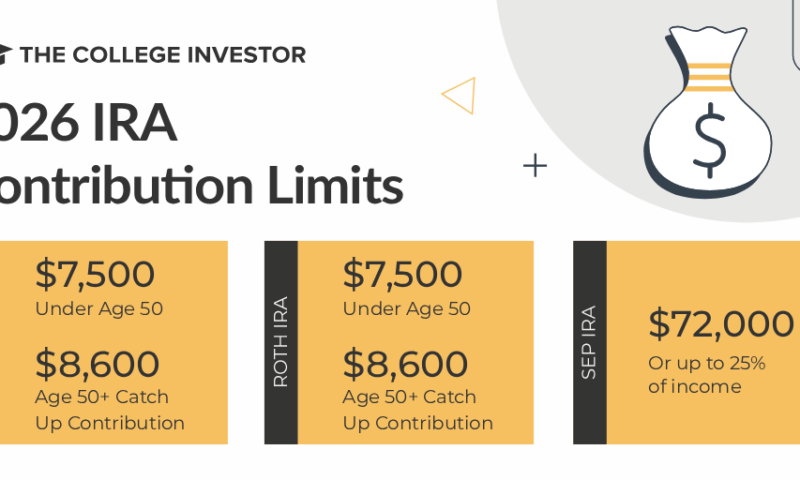

Individuals may contribute no more than $7,500 per year to a traditional IRA or Roth IRA (combined). The maximum rises to $8,600 per year for people over 50.

Roth ira backdoor strategy

Anyone who earns income above the limits set by the IRS is excluded from contributing directly to a Roth IRA. However, they can still contribute pre-tax money to a traditional IRA. This opens up the option of using a backdoor Roth strategy.

Once someone puts money into a traditional IRA, they can convert it to a Roth account at any time. Assuming the funds placed in the account are the only funds in a Traditional IRA, SIMPLE IRA, or SEP IRA, the individual will not pay any additional taxes on the conversion. The only additional step is to fill out Form 8606 at tax time.

One disadvantage of the backdoor strategy is that it is subject to… Proportional rule. This means that the IRS does not allow you to choose the money you want to transfer. So if you have a mixture of Nondeductible (after-tax) IRA contributions And pre-tax contributions to your IRAs, that’s something to consider.

For example, let’s say you have a total of $60,000 between different IRAs (SEP, SIMPLE, and Traditional). Next, we’ll say that 90% of that money ($54,000) was contributed before tax and 10% ($6,000) was contributed after tax. You’ve decided to convert only $6,000 of your money to your Roth IRA because you assume that none of those dollars will be taxed.

But because of the rule of proportionality, that’s not how things work. In this example, 90% of your transfer will be taxed at your ordinary income tax rate. Only 10% can escape your transfer. They can escape taxes no matter how much money you transfer.

Because of this rule, we recommend that people who want to use the backdoor strategy moving forward should first move all funds from their SIMPLE, SEP, and traditional IRA accounts into their 401(k) or Solo 401(k) accounts.

How to Complete a Backdoor Roth IRA

Proportional wrinkles aside, the Roth backdoor process is a relatively straightforward process that involves some fancy paperwork. The first step is to convert any existing “pre-tax” IRAs to an individual 401(k) or a workplace 401(k).

If you’re self-employed and use a SEP IRA or SIMPLE IRA, you’ll need to start a 401(k) plan and then deposit your money into that account. The Roth backdoor doesn’t work well if you have pre-tax money in SEP, SIMPLE, or traditional IRAs. Only attempt a Roth when you have $0 in SEP, SIMPLE, or traditional IRAs.

Next, contribute $7,500 ($8,600 if you’re over 50) to a traditional IRA. We recommend using a brokerage firm that has both traditional and Roth IRA accounts. After settling the money in a traditional IRA, convert it to a Roth IRA (this is as simple as making the conversion if it’s in the same company).

Finally, at tax time, you’ll need to fill out Form 8606. Tax software like TurboTax makes this easy. But you need to be careful when entering the information correctly.

Pitfalls to avoid when trying to backdoor Roth

Although the Roth backdoor strategy is simple, its implementation can be a failure. These are some of the risks to avoid when using a backdoor Roth strategy.

Use backdoor manure when you don’t have to

A Roth backdoor strategy is just one for high-income earners who want to bypass the normal rules for Roth contributions. Use the strategy only if your annual income is above the limits set by the IRS for contributing to a Roth IRA.

Don’t max out your basic retirement benefits first

Most high-income earners can fully fund a 401(k) Health Savings Account (HSA), and Backdoor dung. However, if cash is tight, focus on direct contributions before fiddling with fancy papers.

Having pre-tax funds in your converted IRAs

If you have previously contributed money to an IRA, you will have to pay the ordinary income tax rate on the portion of the money you plan to convert to a Roth IRA. To avoid this, first move money into your 401(k) to achieve a $0 balance before starting a backdoor IRA.

Cross calendar years with contributions and transfers

The Roth backdoor is much easier when you contribute to a traditional account and complete the conversion in the same calendar year. Ideally, your 2026 backdoor Roth will be started and completed in 2026. If you can’t do that, you should probably hire an accountant to help you file your taxes, so you can get the tax benefits you expect.

Open a SEP or SIMPLE IRA after the Backdoor Roth is complete

Form 8606 It asks for the total value of SEP, SIMPLE, and Traditional IRAs at the end of the tax year. You want this number to be $0. If not, you may face tax consequences. To avoid unintended taxes, do not open a traditional, SEP, or SIMPLE IRA after completing a backdoor Roth until the following tax year.

Forget Form 8606

The back Roth is all about fancy paperwork. Be sure to complete Form 8606 before filing your taxes. Most major tax software packages support Form 8606, but you’ll need to double-check before using the software.

Handling too many transactions

A backdoor dung should involve exactly two processes:

- Put money in a traditional IRA

- Convert it to dung.

It doesn’t make sense to contribute slowly to the account over the course of a year and risk earning too much appreciation. The longer you wait, the more money is likely to grow within a traditional IRA, in which case you may run into tax issues with the conversion.

Final thoughts

The backdoor Roth IRA is just a strategy for high-income earners. But it’s a useful strategy to understand if your income is rising quickly and you may be above the income limits for Roth contributions.

If you fit that description, a Roth backdoor could make a lot of sense. Although it requires a little paperwork, it allows you to avoid more taxes in the long run. As long as you are diligent about keeping records and filing Form 8606 with your taxes, the strategy should work well.

Also keep in mind that if you have a Solo 401k, you may be able to contribute up to $46,000 to your Roth IRA annually by completing Mega Backdoor Roth conversion. To learn more about who might want to consider a huge tailgate Roth and how to do so, visit Check this guide.