Markets in 2025 will be volatile, with Bitcoin swinging 5-10% daily amid US-China tariffs and 2.7% inflation. Swing Failure Patterns (SFP) are major reversal signals, helping traders spot tops and bottoms in cryptocurrencies or stocks. What is SFP in trading? This occurs when the price fails to maintain a new high or low, trapping breakout traders and triggering reversals. With 80% of retail traders losing money due to wrong moves, SFPs provide an advantage. Copy trading can automate this, mirroring the SFP plays of professionals. This article explains how SFPs work and how to use them for smarter trading.

Anatomy of oscillation failure modes

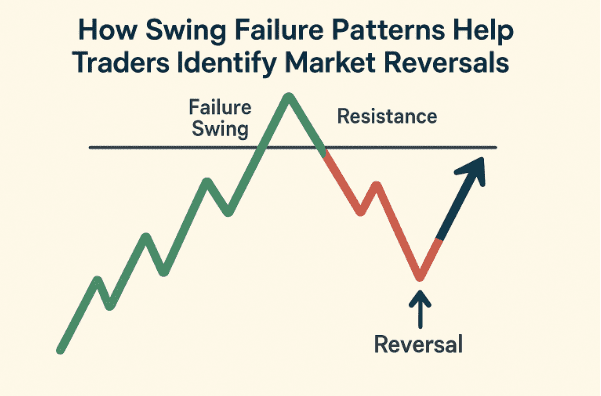

SFP is formed when price breaks a high or low but quickly reverses, failing to maintain momentum. In a bullish SFP, the price crosses the previous high, triggers a stop, and then falls below it, trapping long trades. A bearish SFP is the opposite: a new low is broken, stops are triggered, and then the price surges higher.

For BTC at $110,591, a bullish SFP could see a rise to $112,000, then a decline to $110,500. Trading volume rises on the breakout, and fades on the reversal, confirming the trap.

SFPs shine in diverse or popular markets. They indicate exhaustion, with RSI divergence (above 70 at highs, below 30 at lows) adding confluence.

How SFPs indicate market reversals

SFPs trap breakout traders, causing sentiment to change. A bullish SFP at $112,000 BTC high on low trading volume indicates a weak rally. Short trades accumulate, causing prices to fall with cascading stops.

In stocks, SFPs at earnings gaps reflect trends. Tech stocks gap to $150 on hype, then close below the previous high of $148, suggesting a lower SFP, targeting $140.

Confirmation is key. Wait for the candle to close after the swing point. Scams occur without volume or in strong trends – use 1-hour or 4-hour charts for clarity.

| SFP type | formation | Reverse signal | example |

| Bullish SFP | Penetrating the highest level, failing to hold | Short entry, previous low target | BTC $112K, rising to $110.5K |

| Bearish SFP | Breaking below low, fails to hold | Long entry, previous high target | ETH down $4k to $4.1k |

| The role of size | High at break, fades when reversed | Confirms the trap | 200% up then 50% down |

Trade SFPs with price action and copy trading

Bullish SFP trading by shorting on a close below the failed high, such as BTC at $111,500 after the $112,000 rejection. Stops above the high ($112,100), and previous lower target ($110,000). Risk 1%, reward 2:1.

Bearish SFPs: Buy trades on close above the failed low, stops below, targeting the previous high. Use Relative Strength Index (RSI) divergence to converge – above 70 at SFP highs enhances the odds.

Copy trading reinforces this. Emulate the pros with win rates of up to 80% on SFPs, automating shorts at $111,500. Choose traders with low drawdowns (less than 10%) for safety. Vary 2-3 to balance out false signals.

conclusion

Swing failure patterns are reversal forces in volatile markets in 2025, trapping breakouts to reverse trends. Bullish SFP short failure highs like BTC at $112k, and bearish long failed lows like ETH at $4k. Check volume and RSI, risk 1% for 2:1 rewards. Copy trading puts you in line with the professionals’ SFP timing, enhancing your edge. In volatile ranges or trend ends, the SFP breaks through the noise – trading it disciplinedly, turning traps into profits.