Key points

- If you claim the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC), your refund will be held up until at least February 15, 2026 due to the PATH Act.

- Tax season isn’t likely to start until February 17, so this could be moot in 2026

- Early refunds to affected taxpayers using direct deposit are expected to be received around March 6, 2026, assuming there is electronic filing and no issues with the return.

If you claim either the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) on your federal return, the PATH Act requires the Internal Revenue Service (IRS) to keep your money Full refund Until at least February 15. But check out the Path Act refund chart below to find out your estimate >>

The PATH (Protecting Americans from Tax Hikes) Act is designed to help combat tax refund fraud that is estimated to cost the government more than $100 million each year. The analysis found that much of the fraud was conducted using “refundable tax credits.”

Tax credits reduce your tax liability dollar for dollar — and refundable tax credits can give you more money than you paid in taxes. This makes them vulnerable to fraud.

However, the result of the Pathway Act is that individuals and families who file tax returns claiming these credits have to wait. They will see their tax refund delayed.

Here’s what you need to know about the PATH Act and when you can expect a tax refund if you claim tax credits affected by the PATH Act.

Would you like to save this?

What is the path law?

The PATH Act, short for Protecting Americans from Tax Hikes, was passed in 2015 as a tax reform bill. This bill had 50 tax credits and deductions, and also made many popular tax breaks permanent.

However, one of the biggest impacts of the PATH Act was the delay that was required for some tax returns to combat tax fraud. Specifically, taxpayers who have filed tax returns that include the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC). They can’t get their tax refund before February 15th.

The reason for the delay is that tax refunds are made on a “first come, first served” basis. And if you were to file a fraudulent tax refund, you would do so well in advance so that the real taxpayer has not yet filed.

An evaluation of fraudulent returns found that returns with EITC and CTC were common reasons these tax credits were refundable — meaning you could get back more money than you paid in taxes.

PATH Act Recovery Scheme

As a result of the PATH Act, individuals and families who file their tax returns with the EITC or CTC must wait until after February 15 of each year. Since the IRS may not even start processing returns until February 17 of this year, and most filers can expect their refund within 21 days, this may not have as big of an impact compared to years past.

You can view our “regular” estimated tax refund calendar here.

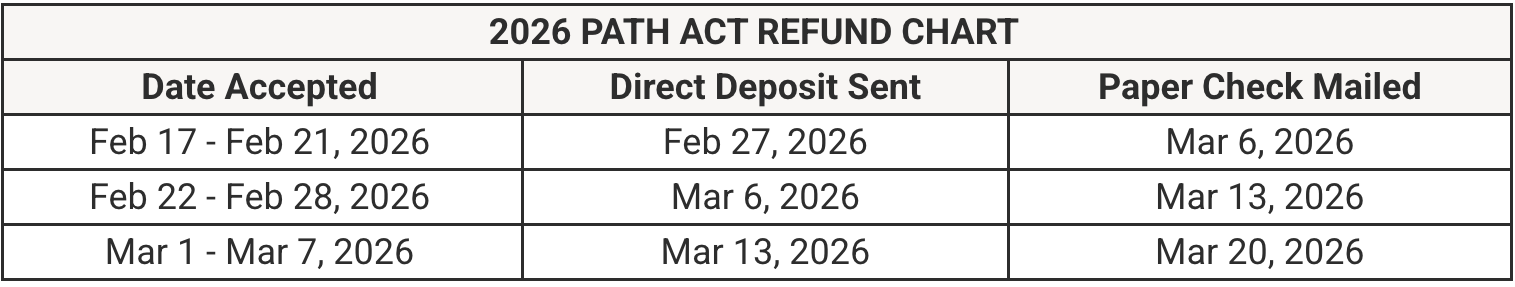

Based on previous years’ data, people with PATH ACT refunds typically see their tax refunds arrive in the first week of March. For 2026, we expect the earliest tax refunds under the PATH Act will arrive around February 27, but the bulk of earlier filers will see their refund the week of March 2. Some may not even get their refunds until the week of March 9, depending on when you filed your tax return.

Remember, we estimate that the IRS will not even open to e-file until February 17th.

Here’s the HTML version of the Path Law refund chart:

2026 refund scheme | ||

|---|---|---|

Acceptance date | Direct deposit has been sent | The paper check was mailed |

February 17 – February 21, 2026 | February 27, 2026 | March 6, 2026 |

February 22 – February 28, 2026 | March 6, 2026 | March 13, 2026 |

March 1 – March 7, 2026 | March 13, 2026 | March 20, 2026 |

Remember, if you file your tax return after the mandatory delay period, your tax return (and tax refund) will be processed normally.

Unintended consequences of the PATH Act

One of the biggest unintended consequences of the PATH Act is that millions of low-income families must wait nearly 6 additional weeks before getting their tax refund. As a result, many of these same families are turning to tax refund advance loans to bridge the gap.

The Government Accountability Office (GAO). He studies It found that more than 20 million households have used tax refund loans, and that number is rising. Considering that 25 million households file the EITC (and 31 million are eligible not to file a tax return to claim it), according to IRSThe connection is amazing.

While the PATH Act works to reduce refund fraud and save the government money, it can also cost taxpayers money nationwide in tax refund loan fees, interest, and more.

Frequently asked questions

Below are some frequently asked questions about the PATH Act.

What is the path law?

The PATH Act, short for Protecting Americans from Tax Hikes, was passed in 2015 as a tax reform bill.

What are the biggest consequences of the Path Law?

The biggest consequence for taxpayers is that tax returns that include the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) cannot be processed before February 15th. The result is that these tax refunds are delayed until early March.

Is the path law a good thing?

The PATH Act has reduced tax refund fraud, which is estimated to cost the IRS $100 million annually. However, delays in processing tax returns place a burden on many low-income Americans.

When will I get my PATH refund in 2026?

If you e-file early, choose direct deposit, and don’t have any issues with your return, most of your refund should arrive by March 9, 2026.

Editor: Ashley Barnett

Reviewed by: Colin Greaves

The article Path Act 2026 Tax Refund Dates appeared first on The College Investor.