In the rapid financial scene today, individuals with high value restore the definition of what the investment means. Besides the traditional portfolios, they dive into the lifestyle investments that reflect their passion and values. From art and real estate to sustainable projects, these options not only offer possible financial returns, but also provoke the enrichment of their lives in purposeful ways. Just as the tendency to real estate includes practical steps such as submission Located before the young To protect the health of the grass in the long run, many investors see lifestyle investments as a way to grow both growth and flexibility over time.

While we explore this interesting shift, we will reveal how lifestyle has become a vital element in managing wealth. These investments are more than just assets; They are an identity and a way to interact with the world. Attention to well -being also plays a role, as investors are increasingly adopting options that enhance their living spaces, from the conscious design of the environment to simple touches such as natural air freshener that supports healthy environments.

Join us as we move in the dynamic intersection of wealth and lifestyle, revealing the ideas that can inspire experienced investors and those that have just started their journey.

Understanding lifestyle investments

Lifestyle investments reflect the intersection of emotional and investment strategy for high -value individuals. These investments exceed traditional portfolios by integrating personal interests with financial aspirations.

Definition and scope

Lifestyle investments include a wide range of types of assets, including art, real estate, holdings and sustainable companies. These investments are not only driven by cash profit; It often represents values, beauty and personal loyalty. For example, a high -value individual may invest in a contemporary art piece not only for her potential estimate but for his emotional association. The range of lifestyle investments varies greatly, as each type of investment provides unique benefits, which can enhance both the cultural capital of the investor and the financial portfolio.

The importance of individuals with high value

Lifestyle investments play an important role in personal brands and ancient construction of high -value individuals. By aligning investments with personal values, we enhance satisfaction with merely financial returns. For example, investment in sustainable projects not only enhances environmental supervision, but also puts us in our position as leaders in responsible investment. Moreover, lifestyle investments can provide hedging against market fluctuations, as their value often remains stable during economic shrinkage. In the end, these investments were able to deal with our passion actively while contributing to our financial security and public well -being.

Types of lifestyle investments

Lifestyle investments provide unique opportunities for financial growth with compatibility with personal interests. We explore different categories of these investments, focusing on real estate and holdings.

Luxury real estate and real estate

Real estate is a vital component of lifestyle investments. We focus on high -end real estate, holidays, and luxury apartments. These assets not only generate rent income, but also estimated over time. According to the National Association of Real Estate Justice, luxury real estate prices increased by 12 % in 2022, indicating its strong potential in the market. Investing in real estate enhances the personal lifestyle, providing escape or decline. In addition, major sites often result in long -term benefits, financially and socially, which enhances the personal situation and enhances the participation of society.

Candles and art

Knotes and art are another important field of lifestyle investments. Its elements such as rare coins, antique wine, and fine arts can be estimated. For example, art prices have increased by 7 % annually over the past decade, according to ArtPrice. We often buy these assets not only as investments, but also as personal traces. Copies can reflect our personalities and interests, and contribute to cultural and aesthetic appreciation. The unique elements also have a fundamental value and can serve as beginners in the conversation, which enhances social communications with the diversification of investment portfolios.

Benefits of lifestyle investments

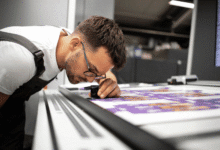

Photography Tira Mayorca is not dye

Diversification and risk management

Lifestyle investments provide an effective way to diversify the governor outside the traditional asset categories. We include holdings, art and real estate to balance market fluctuations. These unique assets are often associated with a different way with traditional investments, which reduces the risk of the total portfolio. For example, the value of luxury real estate in economic expansion can be estimated while maintaining stability during retreat. In addition, holdings such as fine arts show less fluctuations, making them valuable additions to our investment strategy. By integrating these lifestyle investments, we enhance financial flexibility and protect our wealth against uncertainty in the market.

Promote personal satisfaction

Including investment in lifestyle origins deeply with our personal interests, which greatly enhances satisfaction and well -being. By obtaining artistic pieces or choosing sustainable projects, we deal with our emotions and create spaces that reflect our identities. It often causes rare holdings or great pieces of joy, which provides not only financial capabilities but emotional loyalty. We are involved in societal and cultural appreciation through these investments, and contributing to the feeling of belonging and purpose. Lifestyle investments give us this expression of values and emotions while enjoying the trip, creating a unique satisfactory investment experience.

Challenges and considerations

High value individuals face several challenges when engaging in lifestyle investments. We explore the main factors, including market fluctuations and a balance between emotional and financial value.

Market fluctuation

Market volatility affects all investments, including lifestyle assets. High -value individuals should realize that the value of holdings, art and real estate can turn greatly. For example, the ART Rare estimate rate can vary based on directions and demand. Luxury real estate may also face sudden economic transformations, which affects property values. It is important to consider these risks when making investment decisions in lifestyle.

The emotional value against the financial value

Achieving a balance between emotional and financial value is a great consideration of our lifestyle investments. While many origins, such as art and holdings, provide fundamental satisfaction, its financial return may not always be in line with this emotional value. We may invest in the pieces that resonately echo, however the market experience decreases that affects its value. Understanding this division allows us to carefully move investments. We emphasize the alignment of our investment options with our passion and interests, while the awareness of potential financial effects remains. This approach helps us enjoy personal loyalty and a viable investment strategy.