Banks compete as fiercely as ever for students, but which are higher? The 2025 Student Bank survey discovers these answers and more.

Credit: Brother – Shuttersock

Now, in its eleventh year, our survey offers in depth information about how students offer, budgeted and gain their finances.

From the most popular student bank accounts to what influences their choices, opinions about going without effective and beyond, this year’s findings reveal what matters to students in 2025.

Immerse yourself in the complete breakdown below.

Key findings of the 2025 Student Banking Survey

Here is a general description of the key findings of this year’s student banking survey:

- Santander was once again most used bank Among the students surveyed, although their market share has fallen slightly 18%, below 21% in 2024.

- Natwest and RBS came to the top of our Student qualifications In 2025, with the banks receiving respective average scores of 4.34 and 4.32 of 5, compared to an average of 4.04 throughout the sector.

- 15% of the students surveyed seek change banks.

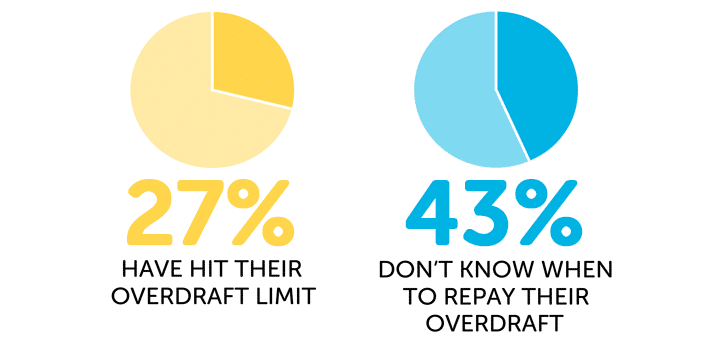

- Among those with overdraft27% have reached its organized limit at some point.

- 27% use Buy now, pay later (BNPL) services At least sometimes. This includes 6% that uses them often.

- 23% have a Isa for life (Lisa) Account, but 22% of those in the survey do not know what they are.

- 54% Use cash Once a month or less.

How do students choose a bank?

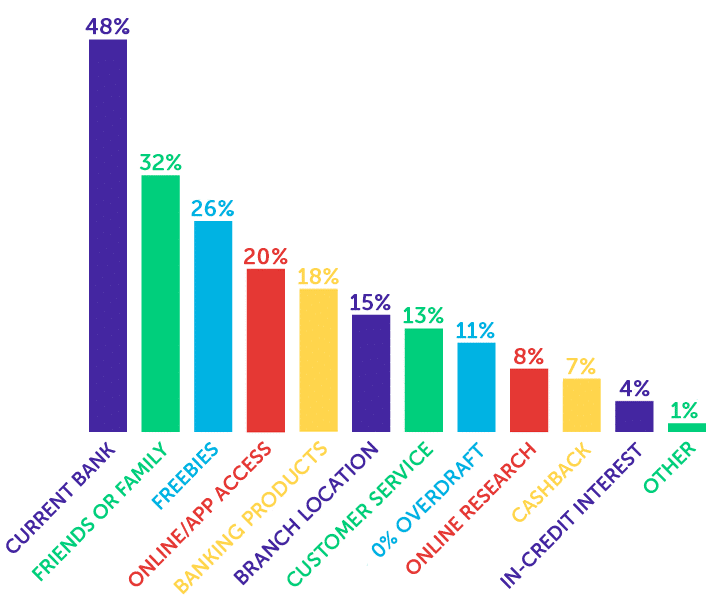

Among the students surveyed, the reasons for choosing their student bank account were the following:

Almost half (48%) of the students surveyed chose their current bank account because they were already addressed there. Since the launch of the survey, this has been constantly the most common reason.

32% chose their account because their friends or family were bank customers. This shows that having previous experience with a bank has great importance among students.

Perhaps it is surprising that the gifts of the student account of the students, with some banks that offer incentives worth more than £ 100, only impacted the decision making of 26% of the respondents.

And, curiously, the proportion of those that are influenced by the 0% overflow fell 15% in our 2024 to 11% survey this year, which put it behind banking products, the location of the branch and customer service for the first time.

The influence of the location of the branch (15%) was also striking, since a similar proportion of those of the survey (14%) told us that they had never set foot in a street bank.

Where do you investigate the bank account account?

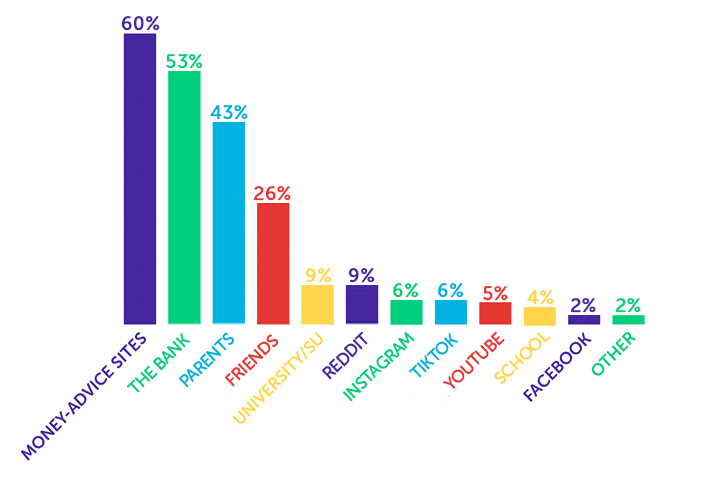

The majority of the students in the survey (60%) resorted to the Websites of Advice money to bank accounts research.

The advice of the parents plays an important role, but the dependence of the banks themselves for information has shot 25% in 2024 to 53% this year. This suggests that more students can now choose to make their own comparisons.

However, the dependence of students on social networks has remained more or less the same, although Reddit’s research has increased by two percentage points compared to last year.

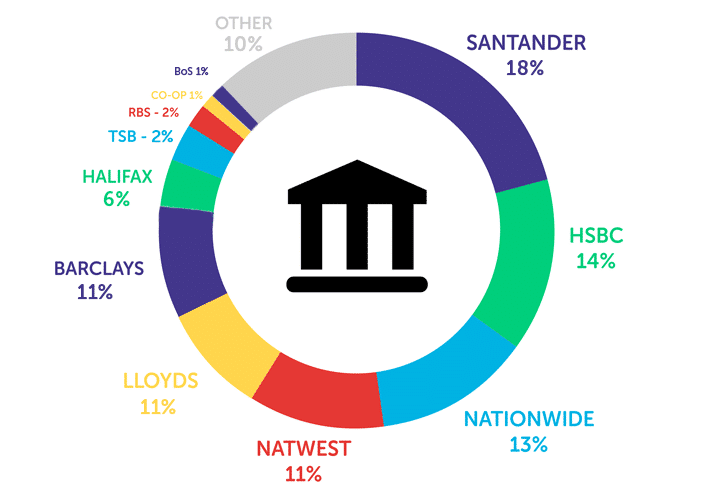

What is the most popular bank among students?

With just under one in five students surveyed with Santander, this was the most common option. Bank participation has fallen slightly versus 2024, with Lloyds, Barclays and Halifax slightly increasing its market share.

In the previous bar table, we focus on banks that offer accounts designed specifically for students. However, 10% of those in the survey said their main account was an alternative bank. These were:

- Monzo (4%)

- Chase (2%)

- Revolutive (1%)

- First direct (1%)

- Metro (1%)

- Starling (1%).

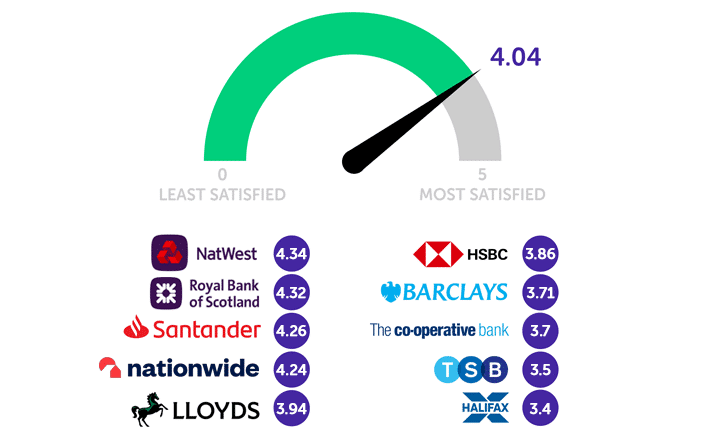

Student satisfaction scores

Note: Little less than 1% of respondents were with the Bank of Scotland, so the average rating was considered too not reliable to include.

Natwest, RBS and Santander include the three main student banks qualified in our survey.

Last year, Santander was left behind Natwest and RB for the first time since 2021. These positions have remained the same in 2025.

Do students consider changing banks?

We always encourage students to buy to get the best offers available to change banks. But, only 15% of those who were on the survey said they were looking to do so.

There were many reasons why respondents gave to change, such as the incentives offered in another place. Similarly, there was a variety of motivations to stay, even not wanting to change, since they thought they could damage their credit score.

This is a snapshot of the key reasons to seek to change bank accounts:

- My current account is boring, it does not offer benefits, interests or incentives.

- Change incentives.

- He will soon graduate, so he can no longer have a student account.

- I would like a more aware of the environment.

- The application is archaic.

And these were some reasons why the respondents decided to keep their current banks:

- It is too complicated to change.

- I am satisfied with my current bank for my needs.

- The savings of the railway card is a great positive and I have always deposited with them.

- I have not seen another account that is significantly better.

- I already have other bank accounts.

Student loan habits

We wanted to better understand how students borrow money while they are at the university, so we specifically ask them about overcoming, credit cards and now buy the payment sites later (BNPL).

How overwhelmed are students?

| Overflow size | Proportion overcome by this amount |

|---|---|

| Not overwhelmed | 70% |

| £ 99 or less | 7% |

| £ 100 – £ 499 | 7% |

| £ 500 – £ 999 | 6% |

| £ 1,000 – £ 1,999 | 7% |

| £ 2,000 or more | 1% |

| Rather not say | 2% |

Of those who were in the survey, 70% said they were not overwhelmed at the time of responding. This is a promising sign, which represents an improvement in 64% that reported the same in 2024.

However, looking only at 28% in their overdrafts, almost one in four (24%) told us that they were overwhelmed by £ 1,000 or more, an increase last year after they also constantly rose in previous years.

27% of people with an overcoming have reached their limit at some point, while 43% do not know when to pay.

There is no doubt that many students appreciate the overflows of 0% offered with their student bank accounts, but others declared that they distrust the stimulus to spend and the reimbursement terms when graduated.

Do students have credit card debt?

A little more than one in 10 students surveyed, he told us that they had a credit card debt. This is consistent with the 2024 (12%) survey, although that result decreased significantly in the 26% that said the same in 2023.

How many students use BNPL services?

There has been an encouraging fall in the use of Buy now, payment services later (BNPL), now 27%, compared to 34% of respondents who said they used them in the survey last year.

However, 6% of the students in the survey said they used these services regularly. In addition, 14% said they had been late to make a payment, which would probably have incurred an additional cost.

There were some positive opinions about BNPL services, but most were negative. Here is a selection of comments from students surveyed:

- They are bad since they encourage you to spend more.

- I think they are fantastic. They are very flexible and they really helped me buy my laptop for the university.

- They make people buy more than they can pay, which leads to greater debt and an unrealistic life.

- They are predators and can be dangerous for financial illiterates.

How many students have isas for life (smooth)?

Lifetime isas (smooth) allows you to save up to £ 4,000 per financial year and receive 25% of annual deposits such as a government bonus.

There has been a slight fall in consciousness compared to 2024 (78% versus 80% last year). However, compared to the 65% that they knew of smooth in 2021, the long -term trend remains an improvement that this is probable because the accounts have been promoted strongly in recent years as effective ways to save for a house.

23% of the students in this survey said they have a smooth, and another 55% say they were familiar with them but that they currently did not have one.

How often students use effective?

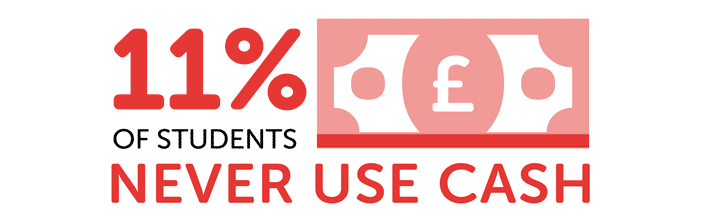

The proportion of students in the survey that never uses effective (11%) has increased from 8% in 2024, almost coinciding with the levels observed during COVID (12% in 2021), when cash payments become less common.

In fact, more than half of the students surveyed (54%) said they use effective less than once a month or never.

Here is a general description of the frequency with which respondents in 2025 use cash:

| Frequency of cash use | How many use this often? |

|---|---|

| More than once a day | 5% |

| Once a day | 2% |

| A few times a week | 11% |

| Once a week | 5% |

| A few times a month | 23% |

| Once a month | 13% |

| Less than once a month | 30% |

| Never | 11% |

We also wanted to measure students’ interest in a society without cash. Approximately one in three (32%) of those in the survey would oppose it, with 14% saying that they would firmly support it.